20/04/2023 After an uptick in market performance at the end of 2022, Q1 2023 has brought happy news of continued stabilisation. Overall, global equities saw positive returns in Q1 as concerns around a potential recession dampened. This being said, two US bank collapses spooked consumers and economists alike, and inflation has continued to rise in many […]

News

Why did Silicon Valley Bank go bust? Here’s what we can learn

20/04/2023 As you have likely read in the news over the past month, a small number of banks have collapsed in the US and Europe. Perhaps the most notable was Silicon Valley Bank (SVB), the US’s 16th largest bank. After this, New York-based institution Signature Bank followed suit on 13 March. Then, in Europe, Credit […]

Can the US meet its $50 trillion net-zero commitment? 3 factors to think about

20/04/2023 The US’s aim to become carbon neutral by 2050 would cost $50 trillion, according to a prediction from a leading economist in an interview with Senator John Kennedy. Questioning former head of risk management at Goldman Sachs and climate policy expert Dr Robert Litterman at the Senate Budget Committee hearing in March 2023, Louisiana […]

All the winners and losers from the 2023 spring Budget

15/03/2023 Just six months ago, Kwasi Kwarteng stood up in the House of Commons and delivered his controversial “mini-Budget”. The announcements ultimately brought down the short-lived Truss administration, with current chancellor, Jeremy Hunt, announcing a series of policy measures in November 2022 aimed at calming the markets. Having taken “difficult decisions to deliver stability and […]

Your spring Budget update – the key news from the chancellor’s statement

15/03/2023 On Wednesday 15 March 2023, chancellor Jeremy Hunt presented his spring Budget. Focusing on the government’s aims to halve inflation, reduce public debt, and boost economic growth, Hunt delivered his first official Budget alongside the latest economic and fiscal outlook from the Office for Budget Responsibility (OBR). “Despite continuing global instability, the OBR report […]

13 notable taxation and other detrimental changes that could have an impact on your money

14 March 2023 You would not be alone in thinking that in recent years, the UK’s financial landscape has undergone a serious shift. Costs have risen for families, individuals, and businesses alike – and at the same time, many tax allowances and exemptions have been frozen or reduced. If you are unaware of the impact […]

How to avoid falling into these 4 easily overlooked pension tax traps when you retire

14 March 2023 As you approach retirement, you may already be aware that your tax situation will change. Whether you plan to continue working part-time in later life or retire completely, as soon as you draw your pension you will likely pay tax differently than you have been throughout your career. An important thing to […]

3 vital ways stagflation could affect your wealth in 2023 and beyond

14 March 2023 As you may already know, UK inflation has reached a 40-year high in the past 12 months. In its most recent report, the Office for National Statistics (ONS) says inflation reached 10.4% in the year to February 2023. Indeed, there is no doubt that your spending power has been affected by the […]

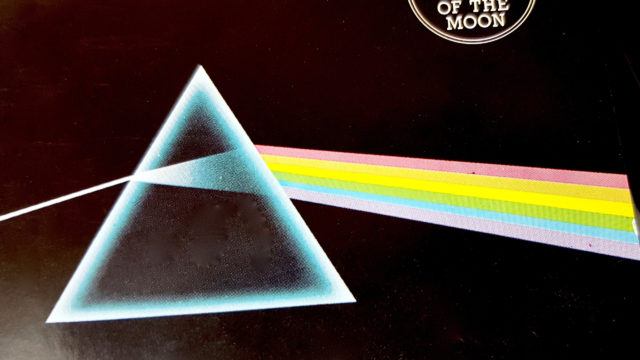

3 things Pink Floyd’s Dark Side of the Moon can tell you about effective financial planning

14 February 2023 Pink Floyd’s Dark Side of the Moon – one of the top 50 best-selling albums of all time, selling 15 million units, according to Insider – turns 50 in 2023. You might have fond memories of listening to this industry-shifting concept album as the years have gone by, but may not have […]

5 important tasks to tick off your pension to-do list in 2023

14 February 2023 When assessing your financial goals for 2023, sorting out the admin for your pensions was probably not at the top of your list. Indeed, more “exciting” financial targets often take precedent, such as expanding your property portfolio, helping the next generation thrive, or taking a bucket-list holiday. Even so, your pension (while […]