11 September 2024 In the UK, the cost of living crisis is still happening. Since inflation reached its peak of 11.1% nearly two years ago (October 2022), it has now slowed to just over 2%. But many forget that the effects of double digit-inflation are still being felt by British consumers – the cost of […]

News

What is the 60% Income Tax trap and how could it affect you?

11 September 2024 Looking back over the course of your career, it’s likely you are extremely proud of the hard work that brought you to your current position. Earning well means supporting yourself and your family as you progress through life, an achievement which may remain close to your heart. Despite feeling happy about your […]

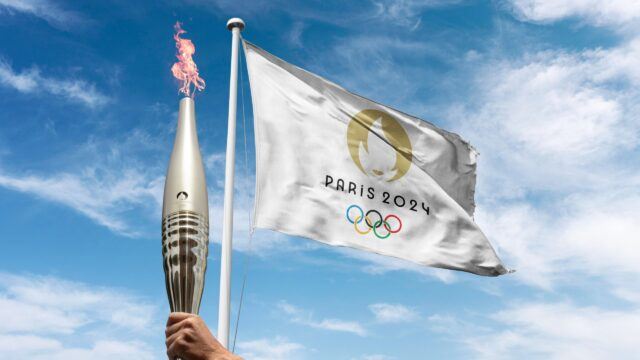

3 lessons about retirement you could learn from the Olympics and Paralympics

11 September 2024 If you’re a sports fan, the summer of 2024 has provided plenty of amazing opportunities to see truly excellent athletes competing to reach the top of their game. The Olympic and Paralympic Games have run between July and September, giving viewers the chance to see sportsmanship at its absolute best. One interesting […]

Over 70? 2 common financial mistakes to avoid in later life

7 August 2024 We often provide written insights about financial planning for those who are on the cusp of retirement, or who have recently retired. But as financial planners, we often meet older clients who have passed the milestone of turning 70 and are wondering: “What’s next?” If you are unsure about how your financial […]

Bereavement: 5 actions your financial planner can help you take in a time of grief

7 August 2024 It is not easy to consider the eventuality of losing somebody close to you, be it your spouse or civil partner, parent, sibling, or a close friend. But as we all know, life has its own plans, and at some point, we may have to say goodbye to someone we love. While […]

Scams: How we’re taking steps to protect our clients, and why this is so important

7 August 2024 At the beginning of 2024, we published insights on the rise in financial scams in the UK, and how to avoid them as best you can. To recap: Sadly, we recently discovered that a Depledge client had been hacked, leading to them believing their Depledge adviser had contacted them. In fact, it […]

Your Q2 2024 global market update

18 July 2024 In April, we reported that six key global stock market indices had all reported positive returns over the first quarter of the year. Thankfully, throughout the second quarter of the year (April to June 2024), this upward trajectory continued, albeit showing more temperate returns than in Q1. The below figures reflect the […]

How the “chrysalis mindset” could help you revitalise your finances in midlife

18 July 2024 As you approach your 40s or 50s, have you begun to hear the phrase “midlife crisis” bandied about more often than before? While friends and family might like to make tongue-in-cheek jokes about buying a sports car or getting a trendy haircut, many people do experience a crisis of confidence when they […]

2 important aspects of passing a property down as inheritance, explained

18 July 2024 A new study, published by FTAdviser, has found that 46% of high net worth individuals are planning to leave their home to their children as part of their inheritance. When you form your “estate plan” – the amount of inheritance you wish to leave when you die, and to who – it […]

What a Labour government could mean for your finances

10 July 2024 In a decisive and historic victory, the Labour Party won the 2024 UK general election with a significant majority and Keir Starmer has become the UK prime minister after 14 years of Conservative government The new chancellor, Rachel Reeves, has already pledged to “fix the foundations” of the British economy in a […]