7 December 2021 Thanks to the fact that Christmas is at the weekend this year, many people will be able to enjoy a few days break during the festive period. Once you’ve eaten your last mouthful of turkey curry or Christmas pudding, you may find yourself with a little bit of time on your hands […]

News

5 really practical tips that will help you to spot an investment scam

7 December 2021 According to UK Finance, in the first half of 2021 an eye-watering £753.9 million was stolen through fraud, an increase of 30% compared to the same period in 2020. While transactional “push payment” fraud accounted for much of this total, losses from investment scams were up 95% year-on-year to more than £107 […]

From awards to new team members – your 2021 Depledge annual review

7 December 2021 As 2021 draws to a close, we can start to reflect on a dramatic year at Depledge Strategic Wealth Management Ltd. There have been so many highlights in what has been a packed year of challenges, triumphs and hard work. So, to look back at the year, here are our thoughts on […]

3 interesting ways Covid has impacted retirement in the UK

10th November 2021 From the way we wash our hands to the shape of our working day, the pandemic has affected our lives in countless ways. Now, a major survey by interactive investor has asked more than 10,000 Brits to identify just how their retirement has been shaped by Covid-19. The Great British Retirement Survey […]

The pension mistake that is costing high earners thousands

10th November 2021 If you’re a higher- or additional-rate taxpayer, then one of the benefits of this is your ability to claim 40% or 45% tax relief on your pension contributions. However, despite this superb tax benefit, new research published in the Telegraph (£) has revealed that 8 out of 10 higher-rate taxpayers eligible to […]

Are interest rates set to rise? What a rate hike means for your savings and mortgage

10th November 2021 Since the global financial crisis in the late 2000s, interest rates in the UK have been at historic lows. Indeed, the Bank of England’s decision to cut the base rate in response to the initial lockdown saw rates fall to the lowest level in the Bank’s 326-year history. However, a recent spike […]

Your Q3 2021 market update

19th October 2021 After a positive few months, the third quarter saw global markets become more uncertain. Fears of rising inflation, increasing fuel prices, and continued Covid issues means the MSCI World Index was essentially flat during the three months to the end of September 2021. Emerging and Asian markets were particularly hard hit, most […]

What the new Health and Social Care Levy means for you and your finances

19th October 2021 On 7 September 2021, the prime minister, Boris Johnson, announced the government’s plans to pay for proposed social care reforms and increased NHS funding in England. The most notable announcements included a new Health and Social Care Levy on employment income alongside an increase in the rates of Dividend Tax. These two […]

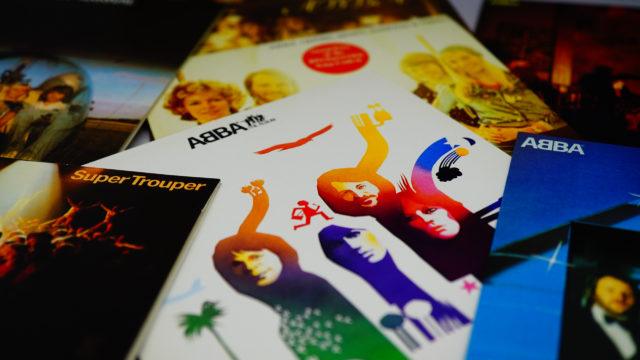

7 things ABBA can teach you about financial planning

19th October 2021 Whether you grew up with their songs dominating the charts, or your first exposure was the musical Mamma Mia, ABBA have been part of the UK’s cultural landscape for almost half a century. Originally formed in 1972, the foursome of Agnetha, Anna-Frid, Bjorn, and Benny recently announced an unexpected reunion, with their […]

Depledge named UK Retirement Adviser of the Year

30th September 2021 Each year, the Moneyfacts Investment Life and Pensions Awards showcase the best service and expertise across the UK’s financial sector. From investment trusts to tax and estate planning, the awards recognise market leaders across a wide range of categories. This year, Moneyfacts has named us as the 2021 Retirement Adviser of the […]