13 January 2025

Welcome to your Q4 2024 global market update. Here, you’ll find a breakdown of how global stock markets performed between October and December 2024.

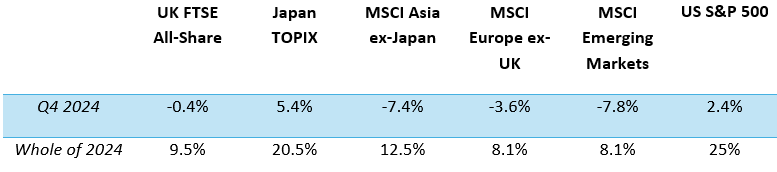

Below is a table demonstrating the performance of six key world indices performed in Q4 and throughout the year.

Source: JP Morgan

As you can see, some regions experienced volatility in Q4, but thankfully, all indices reported significant gains by the end of the year.

Keep reading to discover the events that influenced market performance in the UK, US, eurozone, and Asia.

UK

You could be wondering why, despite positive returns in some other regions, the UK FTSE All-Share posted a negative gain of -0.4% in Q4.

The Autumn Budget, held on 30 October 2024, was one of the main contributors to this downturn.

Ahead of the Budget, rumours swirled about the chancellor raising Capital Gains Tax (CGT) in line with Income Tax, prompting investors to become cautious. MoneyWeek even reported that investors disposed of UK assets worth £4.2 billion ahead of the announcements.

While the chancellor did not raise CGT in line with Income Tax as some suspected, markets proved volatile in Q4 in response to the historic announcements. You can read our full Budget breakdown on our news page.

Although Q4 witnessed a downturn, UK equities performed well in 2024 on the whole. The FTSE All-Share posted a 9.5% return at the end of the year, so despite any volatility caused by the Budget, there’s no need to be concerned about the long-term trajectory of UK markets.

What’s more, the Office for National Statistics (ONS) says that inflation remains close to the Bank of England’s (BoE) target of 2%, standing at 2.5% as of December. After experiencing double-digit inflation during the height of the pandemic, UK consumers may be delighted by this news.

In response to lower inflation, the BoE dropped its base interest rate to 5% in August 2024, and again to 4.75% in November. The BoE had previously held the rate at 5.25% since August 2023, and may be expected to reduce the base rate further over the course of 2025.

And, in additional positive news, monthly gross domestic product (GDP) grew by 0.1% in November 2024 the ONS reports, showing signs of improvement for the UK economy.

US

The US election dominated headlines in Q4, and markets were significantly affected by the event too. On 6 November 2024, it was confirmed that Donald Trump is returning to the White House for a second term.

As you can see below, the US S&P 500 index responded positively to the election result.

Source: Yahoo Finance. Data shown between 8 October 2024 and 8 January 2025.

The Republican candidate has been vocal about imposing harsher tariffs on foreign imports while slashing taxes for American corporations and pushing for deregulation in the finance sector.

Meanwhile, US inflation rose to 2.7% in December, and the Federal Reserve (Fed) cut its central interest rate in September 2024, its first cut in nearly three years, Statista reports. As of December, the rate stood at 4.48%.

With Trump’s victory at the end of the year, and US tech stocks still booming throughout 2024, the S&P 500 ended the year on a high of 25%.

It’s important to note that while it’s natural to be enthusiastic about the success of US markets, staying the course and continuing to diversify your portfolio is crucial.

Read more: 3 crucial investment lessons to learn from market events in 2024

Eurozone

In a stark comparison to soaring US markets, the eurozone experienced harsher conditions in Q4, with the MSCI Europe ex-UK ending the quarter on a downturn of -3.6%.

Although Goldman Sachs forecasts that the eurozone area will avoid recession in 2025, recessionary fears contributed to investor caution in Q4. Plus, Trump’s promises of high tariffs for European and Asian imports caused some company share prices to fall sharply.

For instance, Euronews says several European automakers saw dips, including:

- Porsche (-5%)

- Mercedes-Benz (-6.4%)

- Volkswagen (-4.3%)

- BMW (-6.5%)

More positively, the European Central Bank (ECB) cut its central interest rate twice in Q4, once in October and again in December, bringing the rate down to around 3%, in an effort to boost stagnant economic growth across the region. Inflation is also estimated to stand at 2.4% as of December 2024, Eurostat reports.

Remember, despite the difficulties faced in the eurozone region, the MSCI Europe ex-UK index still ended 2024 on a gain of 8.1%.

So, while it’s important to remain educated on events that affect markets, there should be no need to suddenly dispose of European holdings in your portfolio. Staying calm and sticking to your financial plan is likely to be a more reliable course of action.

Asia

After the Bank of Japan (BoJ) cut interest rates for the first time in 17 years during the summer, markets the world over were affected. But after the subsequent August “sell-off” that saw swift declines in Japanese and US markets, the Japan TOPIX recovered very quickly with a 5.4% return in Q4 and a 20.5% gain across the entire year.

Elsewhere in Asia, markets proved unstable in Q4.

Understandably, Trump’s re-election caused instability in China, after he promised to impose a 60% tariff on Chinese imports to the US. South Korea, Indonesia, and the Philippines were the worst-performing regions in the MSCI Asia ex-Japan, Schroders says.

Further volatility may be inevitable in this region, but there is no need to panic.

Get in touch to learn how professional investment planning could benefit you and your family

As independent financial planners, our mission is to help you achieve your life goals. Investing is one of the key pieces of the financial planning puzzle, but DIY investors often struggle to stay the course and make informed decisions.

To find out more about working with our award-winning team, email info@depledgeswm.com or call 0161 8080200.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Contents are based on our understanding of HMRC legislation, which is subject to change.

Comments on Your Q4 2024 global market update

There are 0 comments on Your Q4 2024 global market update