14 October 2024

In July 2024, we reported that despite some fluctuations, all six of the below indices posted positive returns at the end of Q2.

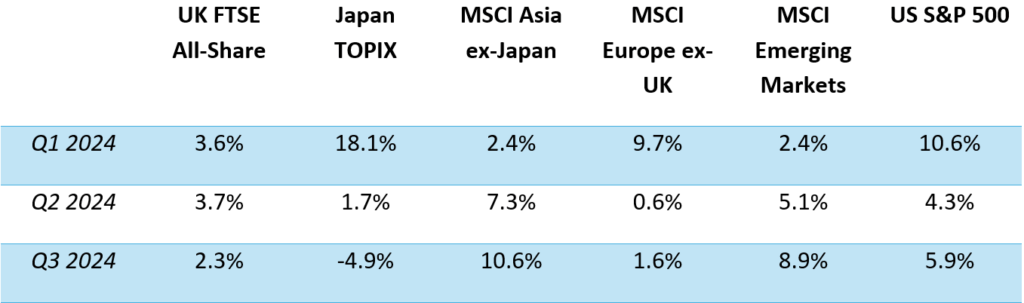

Several significant global events have happened since then. Below are the performance figures for six major stock market indices from around the world in Q3 2024.

Source: JP Morgan

From the above data, we can understand that although there have been some short-term downturns around the world, global stock markets have been on an upward trajectory overall.

Considering that between 2020 and 2023 we experienced a global “bear market” – markets were retreating across the board – this year’s “bull market” has so far provided much-needed relief to investors.

This said, global events including ongoing wars, political elections past and future, and the cost of living crisis, all have the potential to continue affecting several regions around the world.

Keep reading to discover how the UK, US, European, and Asian regions fared in Q3 2024.

UK

The third quarter of the year proved eventful for the UK, with a general election held just days into the quarter on 4 July. The Labour Party’s landslide victory was met with some market volatility, as is usually the case with political elections, which soon stabilised.

In its first three months in government, Labour has made it clear that the “£22 billion black hole” they say was left behind by the Conservatives will need to be filled, and that it is willing to implement harsh measures to do so.

As you might have read in the news, consumers are hotly anticipating the Autumn Budget, set to be delivered on 30 October. It’s expected that chancellor Rachel Reeves will announce heavier tax levies for high earners and potentially reduce pension tax relief for those in the higher- and additional-rate Income Tax brackets too.

So, it may come as no surprise that while the FTSE All-Share index is still posting positive growth, its results were meagre in Q3, perhaps due to consumer trepidation ahead of the Budget.

Though, despite some worries about new fiscal policies coming into force, the UK’s economic landscape proved promising in Q3.

The Office for National Statistics (ONS) reports that as of September 2024, inflation dropped to 1.7%, down from 2.2% in July and August. This is now 0.3% below the Bank of England (BoE) target of 2%, showing signs of stabilisation in the overall cost of living. The BoE kept the base rate of interest at 5% in September.

US

As you saw in the above table, US S&P 500 gains started strongly in 2024 and, although they remain positive, have halved in the second and third quarters of the year. In Q3, this index returned 5.6%, compared to 10.6% in Q1.

In part, this dip in returns has to do with the upcoming presidential election, set to take place on 5 November.

After widespread concern regarding his cognitive health, President Joe Biden announced he would not be running as planned in July, and Kamala Harris replaced him as the Democratic candidate in early August. While this appeared to boost consumer confidence, the much-anticipated election between Harris and Trump is very likely to rock markets in the short term.

What’s more, in Q3, Morningstar reports that a drop in employment rates ignited fresh fears of a US recession – but the country’s wider economic circumstances showed reassuring promise.

The Federal Reserve (Fed) played its part, too, cutting interest rates by half a percentage point after keeping them higher for longer, much like the BoE has done, to help prevent further inflationary conditions. As of September 2024, the rate stands at between 4.75% and 5%.

Eurozone

After experiencing a dip in Q2, returning just 0.6% between April and June, the MSCI Europe ex-UK index rebounded to 1.6% in Q3.

This sluggishness could reflect a continued tendency towards risk mitigation from eurozone investors, with both the war in Ukraine and conflict in the Middle East causing concerns.

In more positive news, Eurostat reveals that eurozone inflation reached 1.8% in September, down from 2.2% in August, reflecting that the European Central Bank’s (ECB) strict interest rate measures appear to have had the desired effect.

Asia

By far the most unstable region in Q3, the Japan TOPIX index returned a -4.6% dip in Q3. Having seen exponential growth in 2023 and continuing to soar in the first half of 2024, the index’s sudden decline is certainly a shock to the system for investors in Japanese equities.

In fact, on 5 August, CNN reports the Japanese stock market saw its biggest downturn since 1987. This has to do with the US labour market dip and recessionary fears, in combination with the Bank of Japan (BoJ) raising interest rates to curb inflation. These two events collided, making the yen less valuable against the US dollar and causing the value of Japanese-dependent export stocks to fall.

However, there’s no need to panic – the very next day, Japanese markets saw an almost immediate rebound, showing just how quickly the market can recover after a crash. The dip did skew the overall Q3 performance of markets in the region, but over the long term, this is unlikely to affect investors’ plans.

Outside of Japan, Asia was the strongest-performing major region in the quarter. China led the charge here, after policymakers announced a suite of economy-boosting measures, giving clear signs that efforts are being made to support the economy after months of stagnation.

Work with us to form a goal-oriented investment strategy

We’re here to support your ambitions by offering bespoke investment guidance.

Email info@depledgeswm.com or call 0161 808 0200.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Comments on Your Q3 2024 global market update

There are 0 comments on Your Q3 2024 global market update