18 July 2024

In April, we reported that six key global stock market indices had all reported positive returns over the first quarter of the year.

Thankfully, throughout the second quarter of the year (April to June 2024), this upward trajectory continued, albeit showing more temperate returns than in Q1.

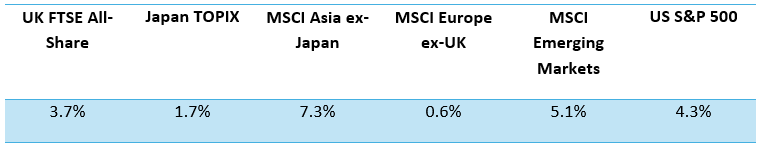

The below figures reflect the gains made in Q2 (April to June 2024).

Source: JP Morgan

Continue reading to learn how markets in the UK, Europe, US, and Asia performed in Q2 2024, plus our insights into why these movements occurred.

UK

The FTSE All-Share is one of the few indices that saw slightly more impressive gains in Q2 than in Q1, returning 3.7% compared to 3.6% respectively.

In part, this continued positive growth may be due to the rate of inflation, which has slowly continued to fall, reaching the Bank of England’s (BoE) 2% target in May and sustaining it in June, the Office for National Statistics (ONS) says.

In response, the BoE is expected to begin cutting its base rate of interest this year – perhaps another reason for the FTSE All-Share’s steady incline. At the time of writing, the base rate stands at a 14-year high of 5.25%, as it has done since August 2023.

Another piece of positive news is that after the UK experienced a recession at the end of 2023, GDP rose by 0.6% in Q1, the Guardian says.

Of course, UK market movements in Q2 are likely to have been affected by the announcement of a general election.

On 22 May, around halfway through the quarter, former prime minister Rishi Sunak called an election and on 4 July (just days into Q3), the electorate voted decidedly for a Labour government.

Indeed, the FTSE All-Share saw a swift downturn after the announcement – a common occurrence after serious events like the calling of an election – and experienced some volatility throughout June. But as you can see from the index’s overall gain across the quarter, volatility is normally short-lived.

To learn more about this topic, you can read our insights into how elections usually affect markets.

Plus, if you’re interested in how a new Labour government might affect your finances, read our full breakdown of the party’s proposed policies.

Read our next market update after Q3 is over to find out how markets reacted to the election between July and September.

US

While the US S&P 500 dipped in value between March and April, by the end of Q2 it had bounced back and delivered a 4.3% return.

US inflation eased to 3.3% in May from 3.4% in April – a slow but steady decline. In a similar vein to the BoE’s prospective plans here in the UK, the Federal Reserve (Fed) is expected to cut its central interest rate in Q3. At the end of Q2, it stood at between 5.25% and 5.5%.

What’s more, according to JP Morgan, the US economy added an additional 206,000 jobs in June 2024 but unemployment rose to 4.1%, its highest rate in four years.

Schroders says that the information technology and communications sectors led the charge for the US’s market gains in Q2, stating that “ongoing enthusiasm around artificial intelligence (AI)” was a key contributor, whereas “weaker sectors included materials and industrials”.

Much like in the UK, the US presidential election is on the horizon and may affect how markets in this region perform in the second half of the year. But remember, election-induced volatility is usually temporary and does not need to affect your financial or investing behaviours.

Eurozone

The MSCI Europe ex-UK produced a somewhat limited return of 0.6% between April and June, JP Morgan reports.

Of course, the ongoing Russian invasion of Ukraine may be dampening returns across the eurozone.

Plus, eurozone inflation has remained “sticky”, rising from 2.4% in April to 2.6% in May, potentially weakening investors’ confidence in Q2. Despite this, the European Central Bank (ECB) cut its three main interest rates from 4.5% to 4.25% in June, which may prove helpful for markets.

Much like in the US and UK, Schroders reports that political changes across Europe were a key contributor to market performance.

This includes the European Parliament election and France’s surprising exit poll results showing its left-wing party, the New Popular Front, beating the right-wing National Rally party in the second round of voting – to name just two important events that happened in Q2.

It is important to note that a financial planner can help you ride out any short-term volatility that stems from events like elections, among other contributing factors. If you’re worried about how these events might affect your portfolio’s value, we can help.

Asia

After posting exponential returns of 18.1% in Q1, the Japan TOPIX index did not match this growth in Q2, producing a gain of just 1.7%.

More positively, the MSCI Asia ex-Japan returned 7.3% in the same period.

Schroders reports that in Japan, “real-term wage growth remained negative as the slow increase in wages has not yet surpassed the level of inflation. This has resulted in stagnant consumer sentiment so far this year.”

In better news, JP Morgan says that a rallying real estate sector boosted China’s economy in Q2, contributing to better market returns than in Q1.

In response to the ongoing enthusiasm towards AI from global investors, Taiwan was the best-performing market in Asia across the second quarter of 2024, Schroders says, and Indian shares also experienced “robust growth” in Q2.

Get in touch to find out how a Depledge financial planner can help you manage your investments

We’re here to help you manage your portfolio over the long term.

Email info@depledgeswm.com or call 0161 8080200.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Comments on Your Q2 2024 global market update

There are 0 comments on Your Q2 2024 global market update