18 August 2021

Global markets continued to rally in the second quarter, primarily because of the ongoing Covid-19 vaccine rollouts. Government support also helped to boost investor optimism for economic recovery in 2021.

However, investors remain concerned about inflation and US rate hikes, which could cause market volatility in the coming months.

The best performing assets over the last quarter have been commodities, mostly due to growth in energy prices.

The strength of the vaccine rollout in developed countries has helped them outperform emerging economies, where vaccines are less available.

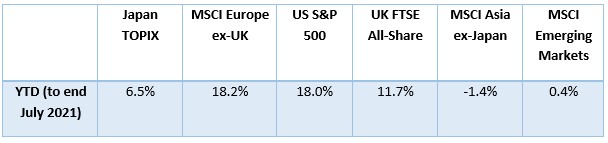

Here’s how the various regional stock market indices have performed so far during 2021.

Source: JP Morgan

Let’s take a closer look at regional performance.

UK

UK equities have performed well, as the FTSE All-Share delivered a return of 5.6% over the quarter. The FTSE 100 and FTSE 250 saw returns of 5.7% and 4.7%, and the FTSE Small Cap index outperformed them all with a return of 9.0%.

Investor sentiment remains optimistic and has been boosted by the ongoing success of the UK’s vaccination efforts. By the end of July, 44.9 million people had received at least one vaccine dose, which accounts for 67% of the population. 33 million people (49% of the population) have had both doses.

Despite this incredible result, we also saw the rise of a different strain of the coronavirus. Scientists estimate that the Delta variant is more contagious than the original strain from Wuhan.

This led to the government postponing the final easing of lockdown restrictions, from 21 June to 19 July. Despite the increase in new infections, strong evidence suggested that the vaccination programme was working; hospitalisations and deaths had not risen as sharply as new case numbers.

Because of the rise in infections and falling inflation expectations, the market struggled in June, and defensive large cap equities were in favour.

Energy also performed well in June, but economically sensitive sectors did not. Banks and insurance companies also performed poorly as market interest rates fell.

Several domestic-focused areas which originally performed well on reopening also fell sharply in June. This was partly because of concerns surrounding the Delta variant affecting further easing of restrictions. In particular, retailers, travel, and leisure sectors performed poorly.

The UK economic outlook was given a boost as GDP forecasts were upgraded by the Organisation for Economic Cooperation and Development (OECD), while the Bank of England said it intended to slow the pace of quantitative easing.

US

Q2 was strong for US equities. The S&P 500 reached an all-time high in late June and almost every sector made gains.

The Federal Reserve’s (Fed) rate-setting meeting resulted in no change to policy, but there were indications that interest rate rises could come in 2023. This news appeared to unsettle investors, but comments from Fed officials a little later sought to dispel worries surrounding tightening monetary policy too quickly.

Overall, the US economy remained healthy. In the first quarter, GDP grew at 6.4% (quarter-on-quarter, annualised), which was only slightly lower than the anticipated 6.7%.

Consumption growth was strong and although inflation data received much attention, in May core consumer price index (CPI) inflation rose from 3% to 3.8% year-on-year. This is the largest increase since June 1992 and is predominantly down to reopening and lifting of restrictions.

Tech giants Apple, Alphabet, and Microsoft all made strong gains over the quarter. Energy, IT, communication services, and real estate were all strong performers. However, utilities and consumer staples performed less well.

Europe

Shares in the Eurozone gained this quarter, thanks to a strong corporate earnings season and the speed in acceleration of the vaccine rollout across the region.

Many European countries saw Covid infections fall and were able to ease restrictions on social and economic activity.

Top performing sectors included defensive areas such as consumer staples and real estate, which had previously lagged in Q1. IT was also among the top performers this quarter. Utilities and energy both lagged.

Eurozone inflation was estimated at 1.9% in June, down from 2.0% in May.

The European Commission also agreed the first of the national recovery plans, which will receive funding from the €800 billion Next Generation EU fund.

Asia

In Japan, economic data suggests short-term negatives rather than a capacity for a faster recovery. Industrial production was weaker than expected, primarily because of a global shortage of semiconductors. This also affected the auto supply chain.

Despite the rise in global inflation expectations, Japan’s data continues to show mild deflation.

While the MSCI ex Japan Index recorded a positive return in Q2, due to investor optimism for a return to normality, this optimism was short lived, and stocks were more muted towards the end of the quarter as Covid Delta infections rose and lockdown restrictions returned.

The growing strength of the US dollar also weighed on returns in June. The change in tone from the US Federal Reserve amid growing concerns over inflation also weakened investor sentiment.

The Philippines was the strongest index market in the quarter, while Taiwan and India also achieved positive gains. China and Hong Kong also achieved modest gains.

Pakistan was the weakest index market, having seen rising rates of Covid infections during the period. The low vaccination rate has led to fears that Pakistan could be hit by another wave of the virus.

Indonesia and Thailand also ended the quarter poorly.

Get in touch

If you have any questions about markets or the outlook for 2021, please get in touch. Email info@depledgeswm.com or call (0161) 8080200.

Comments on Your Q2 2021 market update

There are 0 comments on Your Q2 2021 market update