14th April 2022

Since our Q4 2021 market update in December, the global economy has been shaken following the Russian invasion of Ukraine.

Following the final quarter of 2021, which saw Omicron cases rise across the world, yet still boasted economic growth in the US, UK, and Europe, there has been a downturn in the global market at the start of 2022.

Indeed, the invasion of Ukraine in late February caused equity values to fall in many regions, as concerns about the economic fallout of the war spread.

Russia is a key producer of oil and gas, as well as other valuable commodities like wheat and gold. Their invasion of Ukraine has meant many nations have experienced a significant rise in commodity prices and supply chain issues, further exacerbating rising inflation in the west.

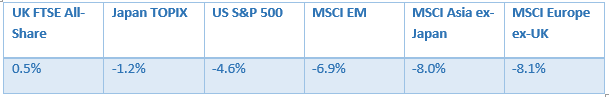

The below table shows Q1 2022 market figures from key indices around the world.

Source: JP Morgan

UK

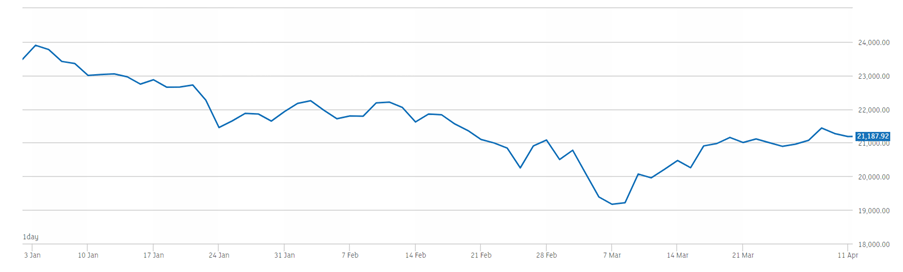

The UK market experienced volatility this quarter, resulting in an overall downturn. Equities fell in January, and this downturn continued until the beginning of March, as you can see from this FTSE 250 graph depicting share prices between January and March 2022.

Source: London Stock Exchange

In March, UK inflation rose to a 30-year high of 7% despite the Bank of England raising its base rate to 0.75% in February in an effort to curb the effects of inflation. Further, the Office for Budget Responsibility (OBR) forecasts UK inflation to hit 7.4% this year.

In response to global supply chain disruptions and the Ukraine war, the OBR altered its forecast for growth over the next five years. The OBR now forecasts GDP to rise by 3.8% in 2022, down from its 6% growth forecast from last October.

Growth in the coming years is now forecast at 1.8% in 2023, 2.1% in 2024, 1.8% in 2025, and 1.7% in 2026.

In the chancellor Rishi Sunak’s spring statement, delivered on 23 March, he announced a temporary reduction in fuel duty of 5p a litre for motorists, along with a three-step tax plan. Read our full summary of the spring statement for details of the chancellor’s announcements.

In response to Russia’s invasion of Ukraine, the UK imposed wide-ranging sanctions. These included pledging to halt all Russian imports of oil and coal by the end of the year, and placing individual financial sanctions against wealthy Russian stakeholders.

US

US stocks declined overall in Q1 2022. President Biden imposed heavy sanctions on Russia in response to the war, including banning all oil imports from Russia to the US, and freezing assets within the Russian central bank.

Despite the overall decline in stock value, the S&P 500 index shows US stocks began to rebound at the end of March.

Compounded with other contributing factors towards inflation in the US, the war is reported to have pushed the country to a high inflation rate of 7.2% in February. In response, the Federal Reserve (Fed) raised interest rates to 0.25%, with experts suggesting further increases may follow this year as a means of combatting the rise in the cost of living.

US unemployment stood at 3.8% in February, but by the end of the quarter had dropped to 3.6%. Wage growth stood at 5.1% this quarter, and while this is positive news for American consumers, wage growth is not yet in line with inflation in the US.

Europe

Europe, overall, may have been the region that was hardest hit by the ripple effects of the Russian invasion of Ukraine. Indeed, European reliance on Russian oil and gas has led to surges in energy prices in the wake of the invasion.

What’s more, consumer spending is reported to have weakened this quarter, due to price rises and growing unease surrounding the war.

In light of this, energy was the only sector to yield positive returns in Europe. Like the UK and US, European inflation continues to rise, with reports of a 7.5% inflation rate in March, up from 5.9% in February.

In response to supply chain issues, and in an effort to sever ties with Russian energy providers, the European Commission has announced plans to cut imports of gas from Russia by two-thirds by the end of 2022. In order to achieve this, the Commission plans to increase investments in energy-efficient alternatives such as wind and solar power.

Asia

An outbreak of the Omicron variant of Covid-19 has damaged Chinese markets, leading to an overall downturn. Both Shanghai and Shenzhen, among other locations, have been placed under lockdown once again.

Outside of China, share prices in Taiwan, South Korea, and Japan all fell. Conversely, Indonesian, Thai, Malaysian, and Philippine share prices rose this quarter, although overall, Asian equities still reduced in value by 8%.

Interestingly, the 1.2% dip in Japanese share prices is incremental compared with that of Asia more broadly. Japan also introduced some gas subsidies that may help citizens shoulder the cost of living in light of the Ukraine war. However, the yen has fallen to a six-year low against the US dollar this quarter.

Get in touch

If you are concerned about how market volatility in the first quarter of 2022 might have affected your investments, or have any questions about what is reported here, contact us.

Email info@depledgeswm.com or call 0161 8080200.

Comments on Your Q1 2022 market update

There are 0 comments on Your Q1 2022 market update