If you’re an investor, you may have come across the phrase “time in the markets, not timing the markets.”

What this means is that it is often more beneficial to stay invested for many years, rather than worrying about whether now is the best time to invest or to withdraw from the market.

To help you understand this principle, here’s the case for staying invested over the long term.

Timing the market is almost impossible

During periods of stock market volatility, it’s human nature to be concerned. We’ve previously looked at ‘loss aversion’ and how the human psyche behaves during market falls.

To try and avoid stock market dips, some investors try and ‘time’ the market. The aim is to buy when prices are at their lowest and to sell when prices reach their peak.

Naturally, this can be lucrative if you get it right. The key issue here is the ‘if’. Not even the most celebrated investors or star fund managers can time the markets and getting it wrong means locking in losses and missing out on gains.

Take a recent example. On March 12th, the Dow Jones experienced its biggest one-day fall since 1987. Had you withdrawn from the market then, you’d have missed out on the single biggest weekly Dow Jones rise since 1974, which happened in the week before Easter.

Looking at the long term

For most of us, investing is about helping us to achieve what we want out of life. Often this is a comfortable retirement, but it could also be financial security for our children or a raft of other ambitions.

Investing in shares can help with these goals. However, while markets have produced positive returns over time, it is never a smooth run. Investing is about accepting short-term risk for the potential of longer-term benefit.

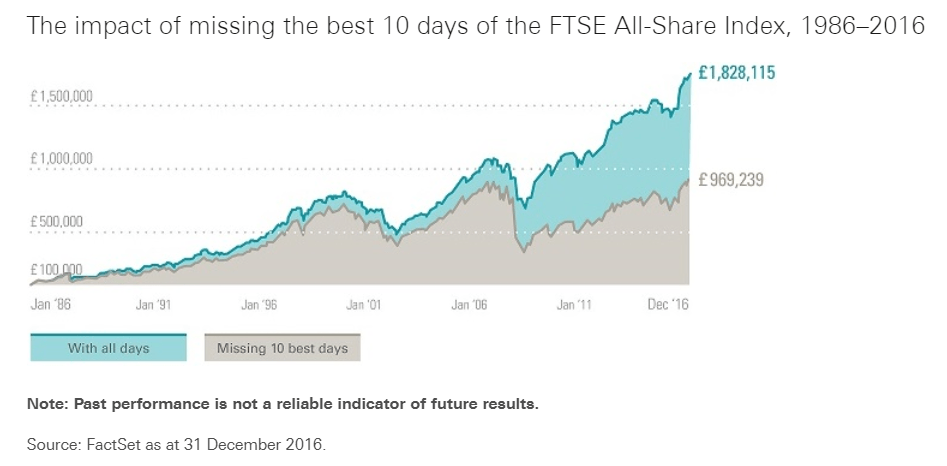

If you examine the data, it’s sometimes surprising how quickly stock markets can generate a positive return. In the graph below, the blue line shows the return of the FTSE All-Share Index since January 1986.

The grey line shows how this return would be eroded if you missed the ten best days over that period.

Source: Vanguard

If you had tried to time the market and you had missed just the ten best days in a 30-year period, you would have roughly halved your return.

It shows that spending time invested in markets leads to success, not trying to time the market to buy at the bottom and sell at the top. If you react to market falls by pulling your money out — even for a short time — you can miss out on potential long-term growth.

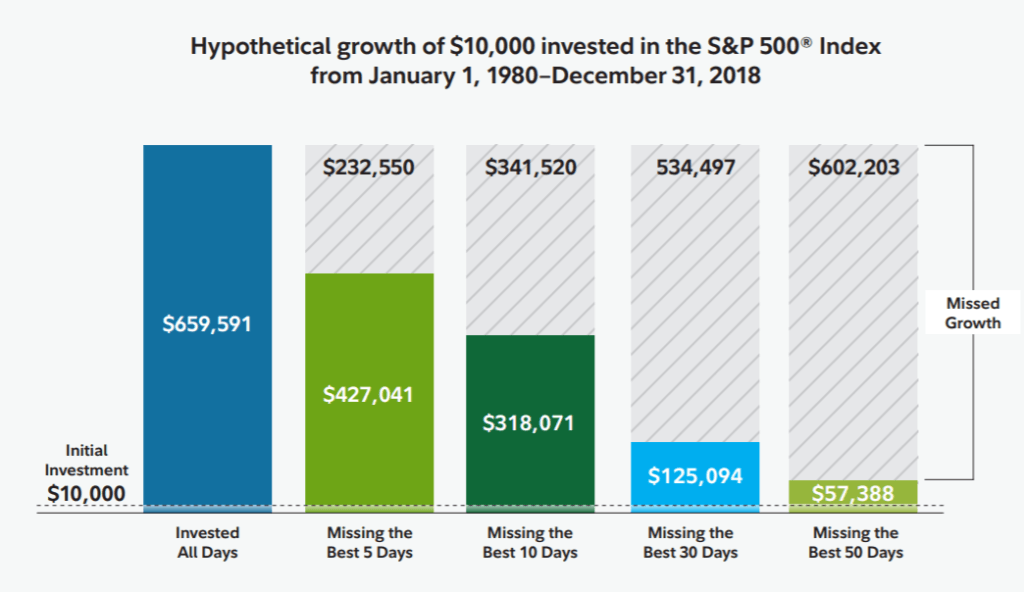

Here’s some more long-term data from the US. Here, Fidelity looked at how $10,000 would have grown had you invested it in the S&P 500 Index from the start of 1980 to the end of 2018.

Source: Fidelity. The hypothetical example assumes an investment that tracks the returns of a S&P 500® Index and includes dividend reinvestment but does not reflect the impact of taxes, which would lower these figures. “Best days” were determined by ranking the one-day total returns for the S&P Index within this time period and ranking them from highest to lowest.

If you had left your $10,000 (around £8,050) invested throughout that entire period, it would have been worth $659,591 on 31st December 2018 (around £531,350).

If you had pulled your money out of the market and you had missed just the best five days in the market during that 38-year period, your total investment would be worth $427,041. You would have sacrificed $232,550 (more than £194,000) simply by being out of the market for five days.

If you had missed the best 30 days between 1980 and 2018, your $10,000 investment would be worth just $125,094 (around £100,770) on 31st December 2018. You would have sacrificed $534,497 of gains – around £430,580 – by being out of the market for just 30 days.

The conclusion to draw is that trying to time when you enter and leave the market can have a significant impact on your returns.

Get in touch

If you need high-quality Chartered advice from one of the UK’s Top-Rated financial planning firms, please get in touch. Email info@depledgeswm.com or call (0161) 8080200.

Please note

The value of your investment (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be regarded over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Comments on Why it’s ‘time in the markets not timing the markets’ that matters

There are 0 comments on Why it’s ‘time in the markets not timing the markets’ that matters