Last tax year, Brits paid £5.4 billion in Inheritance Tax (IHT). The most recent available figures show that 5% of all estates now pay IHT, and so mitigating any potential liability is crucial if you want to avoid leaving your beneficiaries with a bill on your death.

New research has found that more than £17 billion in cash is left to beneficiaries in the UK each year, highlighting the need for financial advice for those in later life.

We look at how financial advice in later life can help you to avoid an Inheritance Tax liability.

Average £69,000 left in cash on death

New analysis from bereavement services firm Equiniti Benefactor has revealed that an average of £69,000 in cash was left per estate in the 2016/17 tax year, while a total of £10 billion in securities — such as stocks, shares and bonds — was handed down at death each year.

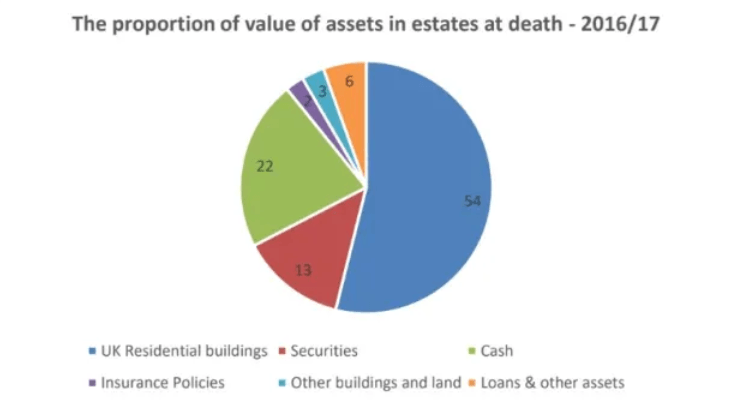

The figures also showed property continued to dominate the value of assets at bereavement, accounting for 54% of the total wealth with a total of £43 billion left behind in 2016/17.

By comparison, securities accounted for 13%, while cash was about 22% of all assets passed down.

Stuart Simpson, Head of Equiniti Benefactor, believes that the figures show the need for financial advice for those in later life. He says: “For estates to be holding nearly £70,000 in cash at the point of death raises questions about how people are handling their finances in later life.

“Even through the process of probate, this wealth will be eroded through inflation.”

Mr Simpson adds that Inheritance Tax could come as a nasty shock for those who were not aware of their limits and the fees their loved ones might incur on wealth that was being passed down to family and friends.

So why is holding a lot of cash on death potentially an issue?

- Inflation – holding a lot of money in cash can mean that your savings lose value in real terms. With many savings accounts paying low rates of interest, it can be hard to keep pace with rises in the cost of living, meaning the value of your savings is eroded by inflation

- Security – if you hold more than £85,000 in cash with one provider then you are at risk of losing part of your savings if that institution were to fail

- Wider estate planning – holding a large sum in cash leaves you with a potential Inheritance Tax liability. Investing this money in other assets might help your estate planning.

Older people least likely to take financial advice

While experts have suggested that older people seek financial advice to avoid having a lot of cash left on their death, a study has revealed that this generation is the least likely to speak to a professional planner.

Research from Sanlam UK has found that older generations are the least likely to speak to a financial adviser, with more than half (51%) of respondents over 65 saying that they had never taken any financial advice. 57% said that this was because they could do it on their own, the survey found.

This research has been backed up by a recent report from the Pensions Policy Institute that found people that have already entered retirement are less likely to seek advice than those aged under 65, despite decisions in later life being more difficult to navigate due to complex pension rules.

The report investigated the complexity of financial decisions that older people may face in later life and found that, in the run-up to retirement (ages 55-64), 19.3% of people had received advice, falling to 15.4% after the age of 65.

The report said people were likely to need much greater support in terms of ongoing guidance and advice in later life in order to be able to make appropriate decisions about how to access and utilise their retirement savings to meet their needs.

The report stated: “Given the complexity of retirement decisions, many people will find it difficult to make choices that will best meet their needs over the course of later life.

“Advice and guidance play an important role in supporting people while making these choices, although most advice and guidance offerings currently focus on at-retirement decisions rather than ongoing support throughout later life.”

The Sanlam UK survey also revealed some stark differences between those who had received advice and those who had not.

Advised clients were twice as confident about being able to retire how and when they would like to (59% compared to 30% non-advised) while two-thirds (67%) of people with advisers had allocated and already passed on money for their dependents. This compared to just 40% for people without an adviser.

Get in touch

If you are approaching or at retirement, taking professional advice can help you to get more from your pension savings. We can also help you with your estate planning needs. Email info@depledgeswm.com or call (0161) 8080200.

Please note

The Financial Conduct Authority does not regulate Inheritance Tax and Estate Planning. Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.

Comments on Why financial planning advice is still essential later in life

There are 0 comments on Why financial planning advice is still essential later in life