What is the 60% Income Tax trap and how could it affect you?

11 September 2024

Looking back over the course of your career, it’s likely you are extremely proud of the hard work that brought you to your current position. Earning well means supporting yourself and your family as you progress through life, an achievement which may remain close to your heart.

Despite feeling happy about your earnings, you might also be concerned about your tax burden. With everyday costs rising and several tax changes having been implemented since the 2021/22 tax year, you could find that your income, while impressive, doesn’t stretch as far as you imagined.

All this is especially pertinent if you earn £100,000 or more.

Keep reading to find out why those earning above this bracket might fall into the “60% Income Tax trap” and how financial planning could help you mitigate your tax bill.

The 60% Income Tax trap, explained

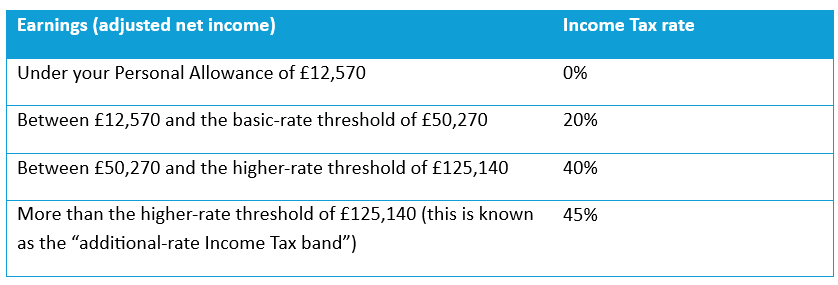

Before we dive into explaining the 60% Income Tax trap, here’s a reminder of the Income Tax bands as of the 2024/25 tax year.

As you can see from the above table, the Personal Allowance is the amount you can earn each year without paying any Income Tax and it stands at £12,570 as of the 2024/25 financial year. However, for every £2 you earn over £100,000, you lose £1 from your Personal Allowance.

Once your adjusted net income reaches £125,140, you won’t benefit from any Personal Allowance at all, and will pay Income Tax on all your earnings.

The loss of your Personal Allowance means that you pay an effective rate of 60% Income Tax on the portion of your income between £100,000 and £125,140.

For instance, imagine that you earn £110,000 – or £10,000 above the £100,000 threshold. You not only pay £4,000 in higher-rate tax (40%) on the £10,000, but you’d also lose £5,000 of your Personal Allowance. That £5,000 portion of your income is now also subject to tax at 40%, costing you another £2,000. So out of that £10,000, you would only take home £4,000 – a 60% effective tax rate.

How to avoid paying 60% Income Tax on a portion of your earnings

If your earnings are within the 60% Income Tax bracket of between £100,000 and £125,140, there is a financial planning strategy that could help you lessen your tax burden.

Increasing your pension contributions, either through salary sacrifice or by paying into your own personal pension, may bring your adjusted net income down and lessen your tax bill in the process.

Here’s how it might work:

- Using our earlier example, you earn £110,000 a year in adjusted net income.

- You would likely pay an effective Income Tax rate of 60% on the £10,000 above £100,000.

- Instead, you route £10,000 a year into your pension and benefit from tax relief at your marginal rate (you’d need to claim higher-rate relief through self-assessment).

- This way, you maintain your entire Personal Allowance, are able to effectively save for retirement, and avoid the 60% tax trap too.

In addition to pension contributions, you could also use salary sacrifice in other forms, such as childcare credits or a leased car, to lessen your adjusted net income and, in turn, your tax burden.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available.

The 60% Income Tax trap is only one way in which you might inadvertently pay more tax than you expect or realise.

Indeed, there’s more to it. With the Capital Gains Tax (CGT) Annual Exempt Amount now standing at just £3,000, down from £12,300 in the 2022/23 tax year, you could pay more tax on the profits you earn from selling your second home, non-ISA shares, and other valuable belongings.

Plus, the Dividend Allowance has been reduced to just £500, down from £2,000 in 2022/23, dragging a greater portion of your dividend earnings into the taxable bracket.

With these and other notable tax law changes in mind, it may be constructive to have a financial planner review your tax situation.

We can:

- Look at your earnings and figure out ways to mitigate your tax liability, if possible

- Talk to you about any future plans (such as wanting to sell your second home in a year’s time, or the date at which you want to retire) and advise on how to do these tax-efficiently

- Create a bespoke financial plan that helps you keep more of your hard-earned money.

You’re not alone in managing your money over the long term. We can help.

Get in touch

To find out more about how our team of experts can help you, email info@depledgeswm.com or call 0161 8080200.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only. It is based upon our interpretation of current HMRC guidance and tax legislation, which may change in subsequent finance acts.

The Financial Conduct Authority does not regulate tax planning.