13 October 2023

In times of market volatility, it’s easy to panic. If you review your investments and see their value fluctuating, the temptation to sell up and return to the “safety” of cash is sometimes understandable.

However, as we discussed in depth last month, keeping a lot of wealth in cash can leave it in danger of becoming eroded by inflation over the years. Whereas, shares have often outpaced the rate of inflation over the long term, despite experiencing short-term fluctuations.

Despite this, you could still be worried about investing while unit values are volatile. This anxiety could have arisen during the Covid-19 pandemic, when a number of indices hit historic lows after lockdowns were imposed around the world.

Fortunately, there is one investment strategy that can not only soothe your worries about stock market volatility, but can even help you capitalise on it. This phenomenon is called “pound cost averaging” – and it’s much simpler than it sounds.

Keep reading to find out how pound cost averaging could help you grow your investment portfolio when prices are uncertain.

Pound cost averaging can help you capitalise on market volatility

Pound cost averaging involves spreading your investments out, rather than buying a high number of units with a single lump sum.

Buying assets with one large lump sum means that you invest a significant amount at a fixed unit price.

On the other hand, if you split the money you intend to invest over several months or years, the price of the units you buy will inevitably fluctuate over that time. Crucially, investing a smaller amount each month means that you buy more units when prices are low, and fewer when prices are high, which can often lead to a greater profit yield in the long term.

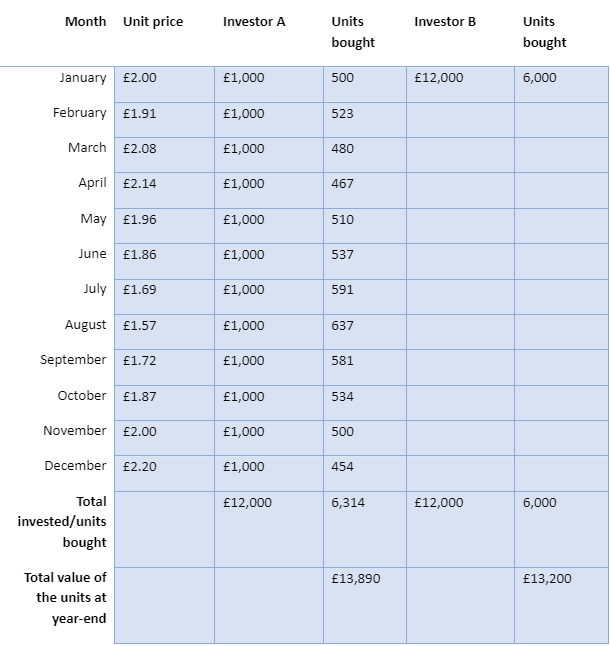

The below table exemplifies how employing a pound cost averaging strategy over a full year, with a total of £12,000 to spend, could compare to making one purchase with the same amount.

As you can see, while both investors have made a gain over the year, drip-feeding the investments means Investor A purchased more units overall, and so was £690 better off by the end of the year.

Of course, this is one example of positive returns that an investor might see from using pound cost averaging. There are also some potential downsides that investors may wish to consider.

So, here are five pros and cons of pound cost averaging.

3 pros of pound cost averaging

1. Pound cost averaging could boost returns during a market downswing

As you read earlier, spreading your investments out across the year can help yield higher returns if market values fall. If you spend a set amount each month, and values fall overall, you’ll buy more units than if values were increasing.

This means that if the market then recovers, you could see more returns from the additional units you bought over the course of the year.

2. Your investment strategy could become more disciplined

If you struggle to know when to invest your money, and perhaps are prone to over-worrying about timing the market, a pound cost averaging strategy can help you become more disciplined.

With a set time frame in mind, you can steadily work towards your goals, without feeling the need to deposit a large lump sum at the “right” time.

3. Your investing confidence could improve

The Covid-19 pandemic has understandably knocked many investors’ confidence. In many cases, unit values plummeted when the pandemic first arrived – even though many recovered to pre-pandemic levels within a couple of years.

Fortunately, a pound cost averaging strategy could help you feel more confident about investing in volatile times. In fact, you could even be more eager to invest when share values are low; markets historically have recovered from dips, so investing throughout market turbulence could pay off in future.

2 cons of pound cost averaging

1. Returns may not be as impressive in a rising market

If markets are on a continuous upward trajectory, returns from a pound cost averaging strategy may not be as impressive as if you bought all the shares in one go, at a lower price.

Of course, it’s impossible to know how markets will behave in future, and attempting to predict such movements can often be a futile exercise. But it is important to understand that if share values rise on average over the year, you’ll buy fewer and fewer units with your money each month, potentially leading to less favourable growth overall.

As such, it may be prudent to discuss your pound cost averaging plans with a financial planner before you set the wheels in motion.

2. Without a set time frame, holding your wealth in cash could leave it vulnerable to inflation

Inflation is highly likely to deplete the real terms value of your cash over the years.

So, if you do wish to put pound cost averaging to the test, it may be constructive to fix a strict time frame over which you’ll invest your entire lump sum as planned. This could help you avoid holding on to large amounts of cash in the long term.

Consulting a financial planner can help you put the theory of pound cost averaging into action

If you wish to become a more disciplined, confident investor during times of volatility, pound cost averaging could be an excellent strategy to explore.

However, there is no “one size fits all” investment strategy that works for everyone – so discussing your unique circumstances with a financial planner first might help.

To learn more about pound cost averaging from an investment expert, email info@depledgeswm.com or call 0161 8080200.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be regarded over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Comments on What is “pound cost averaging”, and how could it help you grow your investment portfolio?

There are 0 comments on What is “pound cost averaging”, and how could it help you grow your investment portfolio?