10 February 2025

In November 2024, Donald Trump was re-elected by US voters, and on 20 January 2025, he was inaugurated into the White House. Having served as President of the United States between 2016 and 2020, he returns to his post after beating Democratic nominee, Kamala Harris, in a closely contested race.

Whatever your opinion of Trump, his policies, and his leadership style, his re-election could spark interesting changes for the global economy and stock markets – some of which may affect your investment portfolio and wider financial plan.

Let’s break down what a second Trump presidency could mean for world economies and stock markets.

Focusing on improving the US economy and boosting domestic markets, Trump is imposing harsh tariffs on foreign imports

You may already know that Trump’s slogan since 2016 has been, “Make America Great Again”.

A businessman himself, Trump’s second presidential term sets the stage for a continuation of his plans to boost the US economy, create domestic business opportunities through tax cuts, and maintain the country’s position as the world’s dominant superpower.

For domestic markets and US business owners, this could be great news. But outside of the US, Trump’s outlook may weaken production, dampen business profits, and even cause supply chain issues.

What’s more, it appears that the president’s strategy is ever-changing, making it difficult for markets, other world leaders, and economic forecasters to predict what’s next.

For instance, on 6 January 2025, the Guardian unveiled Trump’s plans to impose high tariffs on key imports to the US, including China, with an aim of spearheading domestic production of key materials like metal, medical supplies, and energy. According to the report, the president planned to impose a 10% tariff on countries importing to the US, with a 60% tariff applied to China only.

However, according to a BBC report published on 11 February, Trump has since imposed:

- A 10% tariff on Chinese imports

- A 25% tariff on steel and aluminium imports, set to be in place from 12 March.

The president has also vowed to begin introducing tariffs on imports from Canada and Mexico, although it is yet unclear how these will look.

Across the pond, the promise of harsh tariffs on foreign imports has weighed heavily on Europe. Share prices in the region immediately reacted to Trump’s plans – according to Reuters, the share price of European carmakers, Volkswagen, Mercedes, and BMW, all fell between 1.2% and 1.6% on inauguration day. More recently, on 7 February, Reuters says European automakers remain one of the “top decliners” in the region.

After the inauguration, Asian markets posted a “muted” response, the Independent says, with a moderate fall of 0.1% for Japan’s Nikkei 225. After Trump’s promise of a 60% tariff on China did not pull through immediately after the inauguration, the Hong Kong Hang Seng index saw a 0.4% boost, for example. However, in early February, the Guardian reported that Asian markets “tumbled” in response to Trump’s continued promises to put tariffs in place.

With all this being said, as an investor, your long-term plan takes precedent over political elections causing economic and market uncertainty. While Trump’s policy decisions could lead to some volatility – as has been the case for all presidents that came before him – remaining invested and staying the course is normally the most favourable option.

Ensure you consult a financial planner before taking any drastic investment decisions.

Trump plans to slash corporate taxes and push for financial deregulation

One of the Republican president’s major focuses is to slash taxes on corporations and push for deregulation.

According to the Tax Foundation, ahead of the election, Trump’s team proposed to:

- Bring back his 2017 reduction to state and local taxes

- Reduce the rate of tax applied to domestically produced goods

- Decrease or remove Income Tax for certain types of income

- Repeal green energy tax credits

- Impose new tariffs on imports, as you read above.

In early January, Forbes reported that Trump announced a “powerful bill” that he says will tackle tax, immigration, and energy, focusing on loosening financial regulations while tightening border controls. As of February, Reuters reports that the Republican party continues to push its one-bill strategy forward.

Where the stock market is concerned, these policies could see mixed responses from investors.

A report from Yahoo Finance states that the US S&P 500 was up 3% by the end of January, despite rising bond yields. Many investors are optimistic about the president’s plans to safeguard the free market and create further investment opportunities.

On the other hand, going forward, Trump’s emphasis on scaling back energy-efficient business investment could mean that investors in environmental, social, and governance (ESG) holdings see downturns. The BBC says that the president wishes to formally exit the Paris climate agreement, which commits the US to working with countries around the world to limit the causes of global warming, as soon as possible.

From an economic perspective, increased corporate earnings in the US could lead to opportunities for big business, potentially having an inflationary impact. The US central bank, the Federal Reserve (Fed), could be required to intervene by raising interest rates, after having lowered the central interest rate throughout 2023 and 2024. Its latest decision, on 29 January, saw the Fed hold its interest rate at between 4.25% and 4.5%.

Oxford Economics says that while short-term growth is likely, the medium-term outlook suggests that the world economy could stagnate or be depressed by the Trump administration’s foreign import tariffs among other policies.

The economy and stock markets have always bounced back, no matter who is in power

All this said, it’s worth bearing in mind that the stock market and world economy have weathered all kinds of fiscal policy changes, along with other world events, in the last 100 years.

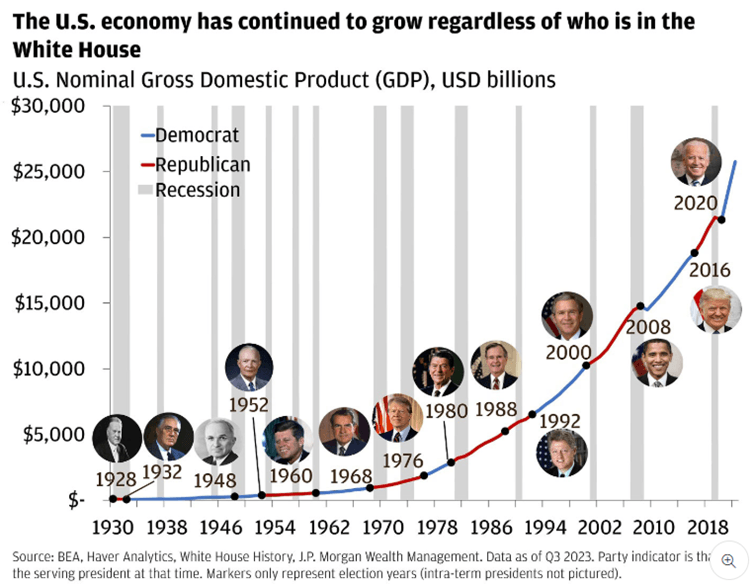

Take a look at this graph depicting economic growth in the US between 1930 and 2024.

Source: JP Morgan

As you can see, no matter who is in power and whether or not there is a recession, the US economy has grown over the long term.

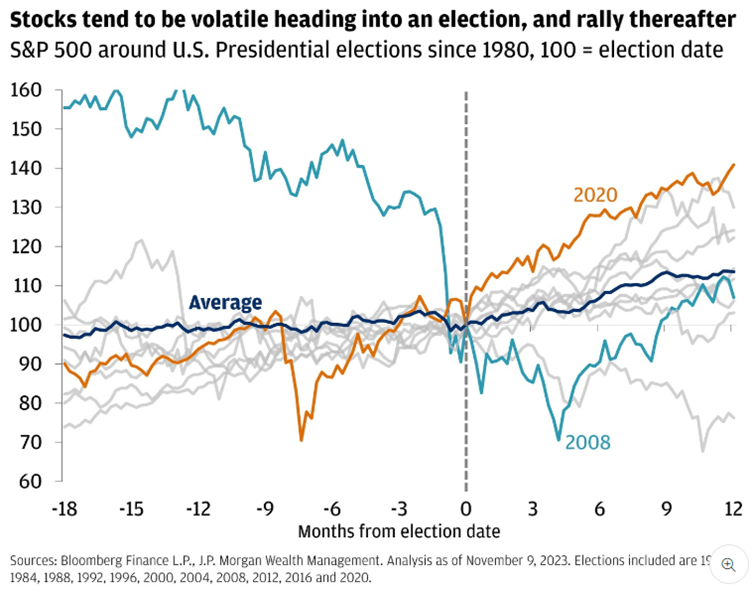

What’s more, as you can see below, elections tend to cause market volatility, but share prices usually rally very quickly. The inherent unpredictability of elections causes investors to remain cautious, but once a winner is confirmed, their confidence is usually restored.

Source: JP Morgan

The moral of the story is: whether you support Trump’s policies or not, and whatever you believe may or may not happen during his second presidential term, your long-term financial plan is the priority.

It may help to take stock of the above data and feel reassured that your goals remain on track, even if the world economy and markets are affected by elections and policy changes.

Work with a bespoke financial planner to create a long-term plan

Working with a professional may put your mind at ease, especially when world events outside of your control affect your investments and future opportunities. We’re here to help you grasp opportunities when they arise and protect your wealth against life’s inevitable twists and turns.

Email info@depledgeswm.com or call 0161 8080200.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Comments on What does a second Trump presidency mean for the world economy and stock markets?

There are 0 comments on What does a second Trump presidency mean for the world economy and stock markets?