20 July 2023

After the challenges that 2022 presented to investors, the first six months of 2023 has brought relief to global markets, although some regions are still seeing downturns as the year goes on.

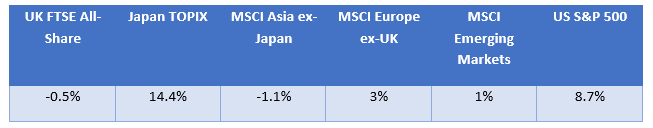

The below table exemplifies how global indices performed between April and June 2023.

Source: JP Morgan

Last time, we discussed the bank collapses in the US and Europe that occurred as Q1 came to a close. Read on to find out how markets fared around the world since then in our Q2 global stock market update.

UK

Although global indices have mostly posted positive returns in Q2, JP Morgan reports that the UK FTSE All-Share index saw -0.5% growth over the quarter.

Indeed, UK equities fell marginally over April, May, and June 2023. Some factors that might have contributed to this somewhat disappointing negative growth include:

- Inflation. UK inflation stayed “sticky”, rising to 7.9% in the year to June 2023, the Office for National Statistics (ONS) reports. Food and energy prices are still rising, while Reuters reports UK wages grew by 7.3% in the three months to May 2023.

- The Bank of England (BoE)’s continued base rate hikes. In response to stubborn inflation, the BoE implemented two further base rate rises in May and June, bringing the rate to 5%. Domestically focused market areas may have faltered as a result of this decision.

- The poorly performing gilt market. As JP Morgan reports, UK gilts were down by almost 4% in the quarter after the BoE’s decision to keep raising interest rates.

Although UK inflation declined somewhat over the quarter, it seems that the BoE has more to do to curb rising costs across the UK.

This means that we may not have seen the end to interest rate hikes yet – in fact, Schroders has adjusted its 2023 forecast to predict that the base rate may reach 6.5% by the end of the year.

In light of this potential continued increase in interest rates, gilts and bonds are likely to continue to fare poorly. This could be challenging for investors holding these assets through an already difficult time, but it is important to remember that interest rates are very unlikely to remain this high for a sustained period.

Of course, there are also questions about whether the BoE’s recent interest rate decisions could trigger a recession later in the year. Happily, the Confederation of British Industry (CBI) has adjusted its forecast to reflect that the UK is “set to avoid a recession”, as it expects the economy to grow by 0.4% by the end of 2023.

While nothing is set in stone, it is hoped that the BoE’s continued increasing of the base rate will eventually prove beneficial for both investors and consumers.

US

In positive news from the US, the US S&P 500 was up 8.7% across the quarter. The IT sector led the charge towards positive growth in Q2, with a particular focus around the AI boom, Schroders reports.

Crucially, according to Trading Economics, US inflation was just 3% in the year to June 2023 – its lowest level since March 2021.

One important factor contributing towards the slow in inflation could be decreasing energy prices in the region. According to the Trading Economics report, the cost of energy declined by 16.7% in June, after already dropping by 11.7% in May. And, fuel oil prices fell by 36.6% in June and gasoline also slumped by 26.5%. Plus, the report reveals that food inflation stood at 7.7% in April, slowed to 6.7% in May, and landed at 5.7% in June.

What’s more, the US economy grew by 2% in the first quarter of 2023, and did so again by 2.1% in Q2.

Interestingly, in a converse move to that of the BoE, the Federal Reserve (Fed) continually raised interest rates since the pandemic, but elected to halt these hikes over May and June, leaving central interest at between 5% and 5.25%. This move could imply that the Fed is confident that inflation will return to its 2% target, perhaps boosting investor confidence in Q2 as well.

Although all this is welcome news, the US could still be heading for a recession before 2023 is over. A June 2023 report from the University of California, Los Angeles (UCLA) newsroom claims that the country is “not in a recession” now, but a “mild recession” could occur in the coming months, depending on what the Fed does next.

Europe

Against the odds of the Ukraine war and the ongoing effects of Covid-19, European markets performed positively in Q2 2023.

The MSCI Europe (excluding UK) posted 3% growth during the quarter. The index saw a downturn of -2.5% in May, but recovered quickly throughout June. Schroders reports that financial and IT sectors were strong contributors to this growth, with energy and communication services dwindling.

Indeed, while Eurozone inflation did see a minor uptick between April and May, growth slowed significantly in the year to June 2023.

The Guardian reports that European inflation stood at 5.5% by the end of Q2, and according to the report, this decline has been influenced heavily by falling energy prices in the region. Food and tobacco inflation remains in double digits, while energy costs fell by 5.6% in the year to June.

Another vital contributor to positive European market performance in Q2 is the European Central Bank (ECB)’s decision to keep interest rates below 5%, with the highest reported rate standing at just over 4% as of 21 June.

While the outlook seems bright, it’s important to note that Europe has not escaped the recessionary worries that the UK and US are experiencing. In fact, Germany entered a recession earlier this year, Reuters reports, and other major economies may follow if inflation and interest do not fall soon.

Asia

The MSCI Asia (excluding Japan) index saw a downswing of -1.1% in the second quarter of 2023. Meanwhile, the Japan TOPIX saw an astonishing uptick, ending June 2023 14.4% up over the quarter.

Of course, China is a huge indicator of Asian market performance overall. And, after investors were relieved to see China’s economy reopen at the start of the year, this initial surge was stifled after consumer spending slowed.

This has resulted in China, along with Malaysia and Thailand, becoming the worst-performing index markets in the region this quarter. In addition, Thai, Indonesian, and Singaporean share prices declined in May, Schroders reports.

Meanwhile, Japanese stock prices have soared in the past two months, as foreign investors increased the momentum behind the technology sector there. The outcome of this is that market values hit a 33-year high, according to Schroders, projecting an overwhelmingly positive view for many sectors in the country.

Working with a financial planner can help you create an investment portfolio that suits your goals

As global indices continue to fluctuate, but remain in a hopeful position in comparison to last year, you might be wondering how to capitalise on these calmer circumstances.

Discussing these opportunities with your financial planner can be massively constructive – and time is of the essence. Whether you’re concerned about your investments or planning to expand your portfolio, we can help you determine a route that suits your life goals.

Get in touch

To discuss anything you’ve read here in relation to your long-term investment goals, get in touch. Email info@depledgeswm.com or call 0161 8080200.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Comments on Q2 2023 global market update

There are 0 comments on Q2 2023 global market update