17/06/2022

Last quarter, you read about the significant market downturns that occurred around the world at the start of the year. The “perfect storm” of the ongoing Covid-19 pandemic and the Russian invasion of Ukraine in February created a difficult environment for markets at the start of the year.

Indeed, throughout Q2, there have been further downturns in most areas. JP Morgan reports that this has been “the worst first half of the year for developed market equities in more than 50 years”.

As inflation soars across the UK, US, and Europe, government bonds have been hit harshly this quarter, after central banks have increased interest rates to curb the rising cost of living.

With interest rates rising, it could be that growth slows, potentially causing further volatility in the months to come.

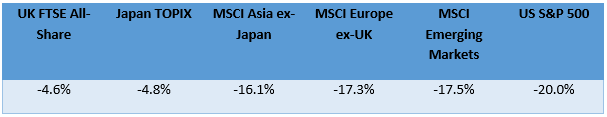

The below table shows the performance of global indices in Q2 2022.

Source: JP Morgan

UK

As you may already know, the Office for National Statistics (ONS) has reported that in June 2022, UK inflation reached 9.4%. In response, the Bank of England (BoE) has raised the base rate to 1.25%.

The effects of inflation and rising interest can be seen on UK households’ disposable income, mortgage repayments, energy bills, and fuel prices.

In May, the former chancellor Rishi Sunak unveiled a new £15 billion package to help families with the rising cost of living. This package will target the 8 million most vulnerable families in the UK. In more positive news, UK unemployment remains low.

As a result of the economic climate, the UK is experiencing “negative wage growth”, leading to what the Office for Budget Responsibility (OBR) is calling the “largest fall in living standards since ONS records began in 1956/57”.

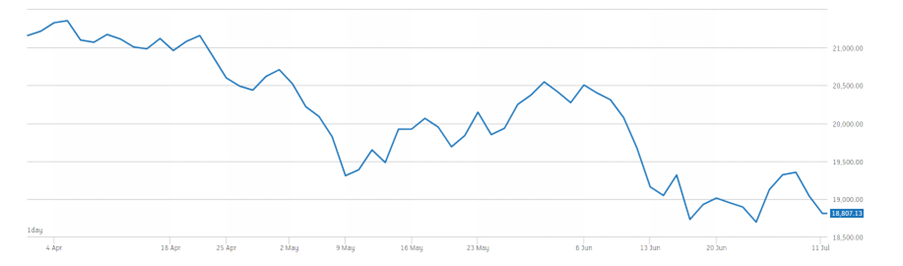

UK equities fell overall in Q2. The below graph depicts the FTSE 250 index between the beginning of April and the end of June 2022.

Source: London Stock Exchange

As you can see, following the drop in values the UK saw in Q1, there was a further dip between April and May, and although markets recovered incrementally at the start of June, there was a further decline at the end of the quarter.

Although past performance is not a reliable indicator of future performance, the BoE forecasts that CPI inflation may surpass 10% this year. This further increase could continue to contribute to volatility in the second half of the year.

US

While unemployment also remains low in the US, the Federal Reserve is forecast to raise interest rates to a 3.8% by next year, in order to combat rising inflation. Just like the UK, according to Bloomberg, US inflation has soared to 9.1% in the wake of both the pandemic and the Ukraine war.

As in the UK, US equities fell overall in Q2. The declines affected all asset classes, although most notably the entertainment, auto, and media industries.

In addition, according to the Guardian, US house prices continue to rise, as the average US home is now priced at more than $400,000. However, the pace of the housing market is beginning to slow, as the economic climate reduces buyer capability across the board.

Europe

The MSCI Europe index reports an overall European decline of 17.3% in Q2 2022.

What’s more, according to Statista, European inflation reached 8.8% in May 2022, with energy being the most significant contributor to the rise.

The continuing war in Ukraine has contributed to a continued market downturn across the eurozone. Consumer confidence in Europe is reported to be decreasing, while the central banks are reportedly on the cusp of introducing further interest rate hikes.

With Russia being one of the biggest importers of gas to Europe, shortages have naturally raised prices significantly. These shortages mean that some European countries may begin rationing industrial gas use, as well as household consumption.

Asia

After a difficult start to the year, following the Omicron outbreak leading to further lockdowns, Chinese equities rose over Q2. Relaxations of lockdown laws around the country have helped boost the economy, allowing equities to increase after an intense downswing in Q1.

However, in Japan, the yen weakened significantly against the US dollar, falling to its lowest exchange rate in 20 years. The possibility of a US recession has caused tensions that may have contributed to a further market downturn this quarter.

When it comes to the rest of Asia, the MSCI Asia (excluding Japan) reports an overall negative growth of 16.1%. South Korea was the worst-performing market in this index, with Taiwanese and Indian stocks declining sharply too.

Get in touch

For guidance on how the market volatility seen across Q2 could affect your investments, get in touch. Email info@depledgeswm.com or call 0161 8080200.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Comments on Q2 2022 market update

There are 0 comments on Q2 2022 market update