13 October 2023

If you’re set to finish your career in the next 20 years, you could be beginning to think more seriously about how much wealth you’ll need to fund your retirement.

Indeed, while retirement is an exciting prospect, thinking about your financial circumstances later in life could also bring on some anxiety. In fact, according to a survey of 2,000 UK adults, published by City A.M, 58% of over-40s are “anxious about the prospect of retiring”.

What’s more, 40% of participants said they were concerned that they wouldn’t have enough money to last through retirement, and 13% said they had delayed their retirement plans altogether because of the cost of living crisis.

If you can relate to these feelings of uncertainty, there are ways to regain peace of mind when it comes to funding your own retirement.

Here’s how to soothe your worried mind, from the perspective of a seasoned financial planner.

Plan your retirement in plenty of time

Like any milestone we reach in life, a comfortable retirement requires a lot of forward planning.

If you’re 10 years away from retirement, or less, it may be time to begin actively engaging with retirement planning. This might mean taking a range of practical steps, including:

- Requesting an up-to-date pension statement from all your pension providers

- Talking about how you’d like to draw your combined retirement income with your spouse or partner

- Assessing your current expenses and whether you can continue to fund them in retirement

- Looking at the returns on your investment portfolio, including Individual Savings Accounts (ISAs)

- Paying off any remaining debts as sustainably as you can

- Checking your National Insurance (NI) record to assess how much State Pension you may receive. If you are not eligible for the full new State Pension, you can buy voluntary National Insurance contributions (NICs) for some years before the April 2025 deadline.

What’s more, even if you’re more than a decade away from retiring, there are still important steps you can be taking to strengthen your retirement fund now.

For instance, a new study from Standard Life demonstrates the importance of starting and maintaining regular pension contributions from a young age.

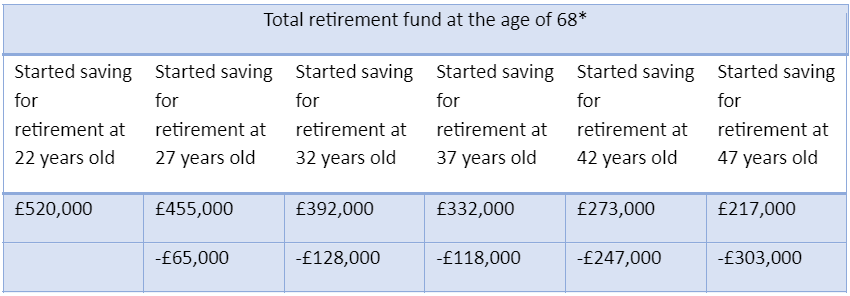

The below table illustrates how the value of a person’s pension pot when they reach age 68 could be affected by the age at which they started contributing.

*If beginning working with a salary of £25,000 per year and paying 5% employer, 3% employee monthly contributions into a workplace pension and assuming 5.0% investment growth and 3.5% salary growth per year. Figures are not reduced to take effect of inflation. Annual Management Charge of 0.75% assumed. The figures are an illustration and are not guaranteed. Earning limits not applied.

Source: Standard Life

If you did begin making pension contributions later in life than you’d have liked, now may be the time to consider increasing your payments within the Annual Allowance. As of the 2023/24 tax year, the Annual Allowance stands at £60,000 a year or your total earnings, whichever is lower, for most people.

Ultimately, even if you’re not in the “active” retirement planning stage just yet, understanding the benefits of lifelong pension contributions could motivate you to prioritise them.

And, crucially, this early preparation could reduce your anxiety about affording a comfortable retirement.

Work with a financial planner to see data-driven projections of your potential retirement income

Even when you’ve been diligently making pension contributions, and saving elsewhere, you could still be left wondering: “How much can I afford to pay myself from my retirement fund?”

Indeed, funding retirement involves spinning many plates at once. Some important factors that may have an impact on your wealth in retirement include:

- The amount of tax you’ll pay. When drawing from various sources to make up your retirement income, you could attract a combined Income Tax, Capital Gains Tax (CGT) and Dividend Tax liability.

- Inflation. As inflation rises, the spending power of your retirement income may be dampened as a result.

- The performance of your non-pension investments. If you plan to draw from ISAs and other investments you hold to pay for retirement, how these have performed in recent years may affect your financial viability in retirement.

- Your expenses. If you’re still paying off your mortgage, or are supporting children or grandchildren financially, these factors may have an impact on your overall expenditure.

- Later-life care. You may need to pay for later-life care, either for yourself or a loved one, in retirement.

Fortunately, working with a financial planner can help to reduce guesswork and offer data-driven projections of your retirement income.

With the help of cashflow modelling software, we can assess all the above factors (among others) and produce a report of how much you can afford to take as income in retirement. While circumstances can always change, assessing these variables as you approach retirement might offer a realistic view of your financial future.

And, most importantly, having a data-backed retirement plan can offer invaluable peace of mind to you and your family.

To start your retirement planning journey today, email info@depledgeswm.com or call 0161 8080200.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future results.

Workplace pensions are regulated by The Pensions Regulator.

Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor. The Financial Conduct Authority does not regulate tax advice.

Comments on More than half of over-40s are anxious about retiring. Here’s how to soothe your worried mind

There are 0 comments on More than half of over-40s are anxious about retiring. Here’s how to soothe your worried mind