10th June 2021

These days, you probably insure your home, car, bike and even your mobile phone. However, despite an increase in interest during the pandemic, many people still don’t see life and health insurance as a priority.

Indeed, a recent survey by insurance company Drewberry found that, in the last 12 months, more people bought pet insurance than life insurance, income protection, or critical illness cover.

There’s a range of objections to taking out protection, from cost to cover. Here are three of the most common, and why these myths are not quite what they seem.

1. Life insurance is too expensive

One of the main objections to life insurance is, simply, that “it’s too expensive”. However, the cost of cover is often a lot less than you might anticipate.

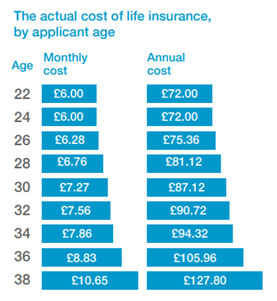

In a major study, Legal & General asked more than 2,000 millennials to guess the typical monthly cost of a life insurance policy to cover a 30-year-old non-smoker with a cash sum of £100,000 for 30 years.

The outcome of the study was surprising. The median guess was £23 per month, with almost a quarter of respondents giving an estimated cost of more than £50 per month.

The actual cost, according to L&G, is just £7.27 per month. So, on average, respondents believed that life cover was three times more expensive than it actually was.

Source: Legal & General

Of course, this is just the cost with one provider. Shopping around for cover from a range of insurers could mean the cover you need is even cheaper!

What this shows is that your perceptions of the cost of protection might be very different from the reality, and that putting the right protection in place might only cost a few takeaway coffees each month.

2. I don’t need life insurance

Insurance is designed to give you the peace of mind that, should the worst happen, there’s financial support in place. We routinely protect our home, car, and pets because we want to be sure that we’ll receive a payout if something unexpected happens.

However, in a 2020 survey reported in FT Adviser, 3 in 10 of those without financial protection said they didn’t have cover because they thought it was a “waste of money”.

If you understand why it’s important to insure your cat, bicycle, or smartphone, the same logic that dictates you should insure your most valuable asset – yourself.

If you believe you don’t need life insurance, ask yourself these questions:

- Would your loved ones be able to maintain their standard of living if you died?

- Could you carry on paying your bills if you were forced to take an extended period off work due to illness or injury?

- Who would provide for your children if you were no longer around?

- Could your family remain in your home if you died?

Thinking about your own health and mortality might be confronting, but it’s important to consider the worst-case scenario and put the right protection in place.

3. It won’t pay out

In the FT Adviser survey referenced above, 46% of all respondents said that they thought life insurance providers would find loopholes to avoid paying out claims.

One of the most common objections to taking our protection is simply: “it won’t pay out”. There is a suspicion of insurers, and a widely held view that they will do what they can to avoid paying out a lump sum when a claim is made.

However, the facts simply do not support this.

The latest figures from the Association of British Insurers (ABI) show that the UK insurance industry paid out more than £6.2 billion in protection claims during 2020, a year-on-year increase of more than £438 million. In total 325,136 new claims were paid in 2020.

Insurers paid 98% of all protection claims, demonstrating that the vast majority of claims were settled.

- Insurers paid more than £3.4 billion in life insurance claims in 2020, an increase of £349 million on 2019. The average payout on term life insurance policies (individual and group) was £79,304.

- Insurers paid £1.13 billion in critical illness cover claims in 2020.

The most common reason for an insurer not paying a claim was “non-disclosure”. This is where an applicant fails to disclose health information when applying for cover, so it’s important to be honest and transparent when completing any protection proposal.

Charlie Campbell, the ABI’s manager, health and protection, commented: “The high number of claims paid should give people confidence they can trust that their insurance provider will be there when they need them.”

Get in touch

Protection can be a reliable and cost-effective way of securing you and your family’s financial security. If you’d like to find out more, and explore what cover might be appropriate for you, please get in touch. Email info@depledgeswm.com or call 0161 8080200.

Comments on “It’s expensive and it won’t pay out” – these and other protection myths busted

There are 0 comments on “It’s expensive and it won’t pay out” – these and other protection myths busted