In recent months there has been significant volatility in global stock markets. Nowhere is this better illustrated than the Dow Jones which experienced its biggest one-day fall since 1987 on 12th March, and its biggest one-week rise since 1974 in the few days before Easter.

Watching stock market turmoil can be stressful, especially if you are relying on equity-based investments and pensions to provide your retirement income. If you are already taking income through unit encashment, or you plan to in the future, it’s important to understand the importance of short-term decisions when compared to the long-term value of your investments.

Here’s some useful advice on ways to manage drawdown during the coronavirus pandemic.

If you’re not yet retired, consider delaying your retirement

If you are in a position to do so, you could consider delaying your retirement for a short period. This has three main benefits:

- More time to rebuild your pension pot

- Less time in retirement for your savings to last

- More time to benefit from employer contributions (if applicable)

Former pensions minister Steve Webb says: “For those who have recently retired, it is not unusual for people to partially ‘un-retire’ and do some paid work if it is available. This may have many advantages and can help soften the blow of a fall in drawdown pots.”

Use alternative sources of income

If you are retiring now, or you have already retired, it could be a time to use some of your other sources of income rather than your pension.

If you have been working with a financial planner, they are likely to have considered your broader investment portfolio in retirement. They will have looked at where it is best to take income from first, allowing for both tax and inheritance considerations.

So, using cash savings may be better in the long term, as the more of your pension you leave invested, the more time it has to hopefully recover.

If you do have some of your drawdown in cash, or you have cash savings, it could pay to take your income from the part of your portfolio that has not fallen in value. This leaves the equity element untouched, giving you the potential of benefiting from future stock market rises.

You may also be eligible to claim your State Pension, which could reduce the need for income from other sources.

Reduce the income you are taking

If you are in a position to do so, you could consider reducing the amount of income you are taking from your pension pot.

Pete Glancy, Head of Policy at Scottish Widows, explains: “In order to take money out you will need to sell units in your investments and, if the prices are low, you will need to sell a higher number to get the desired amount.

“This means that there will be fewer units later that you can use to take more income or buy a guaranteed income for life. If you can’t afford to wait you should therefore consider only taking as much as you need short-term.”

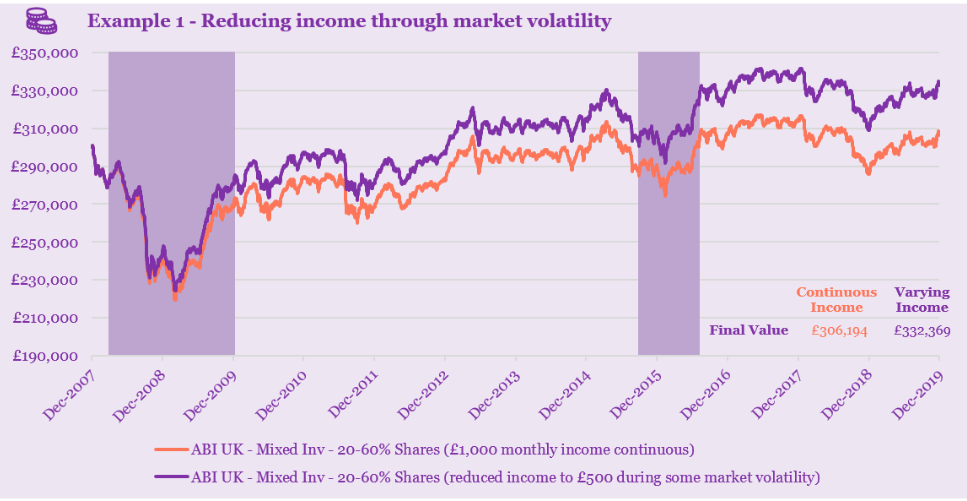

This example from Royal London shows what would have happened if you had invested £300,000 in late 2007, and you are taking an income of £1,000 per month (4% a year).

- The orange line shows the impact of market volatility if you continued to take £1,000 every month over the 12-year period to December 2019.

- The purple line shows the impact of market volatility if you had reduced your income to £500 following some significant market losses, and that you had maintained this level until your investment had time to recover some of the losses.

The shaded area shows the periods when you took a reduced income.

While the benefit of reducing income through these periods isn’t apparent in the short-term, it’s the effect on the long term which is critical.

By taking a reduced income for a short period (through the shaded areas), you would have preserved the fund value which compounds over time. It meant that, after 12 years, the purple scenario could have resulted in you having over £26,000 more in your pension.

Keep reviewing your investments

Working with a financial planner can add value at the best of times, but regularly reviewing your drawdown with a professional is particularly important during difficult periods.

As an investor, you need to keep your portfolio under regular review and take a long-term view. A diverse and balanced portfolio which has a mixture of different asset classes – for example, cash, bonds and equities – is likely to be better protected during market volatility. Diversification can provide shelter when some investments are performing poorly, as long as others are doing well.

This asset allocation may vary in retirement compared to your working life. For example, you may want to select investments you think will pay out a regular income if this is consistent with your investment strategy.

Regularly reviewing your strategy with your financial planner can help you to avoid making knee-jerk decisions that could damage your long-term financial position.

Get in touch

If you want to discuss your investment strategy, or you’re looking for specialist retirement advice, please get in touch. Email info@depledgeswm.com or call (0161) 8080200.

Please note:

The value of your investment (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. The tax implications of pension withdrawals will be based on your individual circumstances, tax legislation and regulation which are subject to change in the future.

Comments on How to manage drawdown during the pandemic

There are 0 comments on How to manage drawdown during the pandemic