Hitting the tax bullseye: Why your Income Tax bill might rise this year, and what you can do about it

10 February 2025

Darts is in vogue in 2025, with more than 3 million people tuning in to watch the 2025 Professional Darts Corporation (PDC) World Championships, Sportcal reports.

In part, the sport’s surging popularity is down to a British teen, Luke Littler, who stormed to victory over darts legend and world champion, Michael van Gerwen. Littler was just 17 on the day he won the Championships, drawing support from fans all over the world.

However, with great power comes great financial responsibility. Sky reports that Littler had earned more than £1 million from darts tournaments even before winning the PDC World Championships in January 2025.

The report states that the 17-year-old will have paid around £452,000 in Income Tax between 2023 and 2024. Plus, he’ll now have to pay tax on his additional Championship prize money of £500,000.

Although you might not be on track to win the next PDC World Championships, like Littler, you could be facing a rising Income Tax bill this year.

Keep reading to discover why some earners’ bills are rising and learn tips for mitigating Income Tax.

Key Income Tax thresholds have recently been frozen, and one has fallen

The Income Tax thresholds mark how much an individual can earn in taxable pay each financial year. Several of these important thresholds remain fixed rather than rising in line with inflation, and the additional-rate threshold was actually reduced in 2023.

Personal Allowance

Firstly, there is a Personal Allowance, under which no Income Tax is normally due, of £12,570. The Personal Allowance has been fixed at its existing rate since the 2021/22 tax year, and remains frozen until 2028.

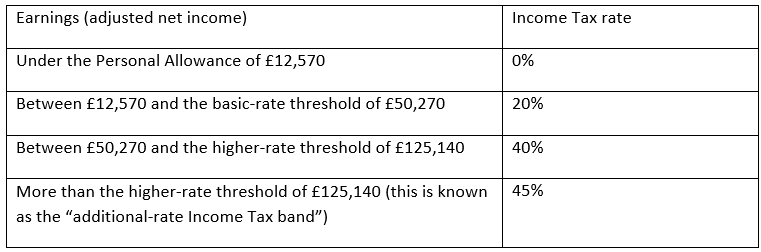

Income Tax bands

Then, there are the Income Tax bands, which stand as follows as of the 2024/25 tax year.

The tapered Personal Allowance and additional-rate threshold

For every £2 you earn over £100,000, you lose £1 of your Personal Allowance. This means that once you earn £125,140 or more, you no longer benefit from any Personal Allowance.

And, in April 2023, the former chancellor announced that the additional-rate Income Tax threshold would fall from its previous cutoff of £150,000 to £125,140.

Essentially, additional-rate taxpayers don’t normally benefit from a Personal Allowance, and some higher-rate taxpayers have a tapered Personal Allowance, bringing their Income Tax bills even higher.

This regime leads to some earners paying 60% Income Tax on a portion of their earnings, which we covered in detail in a previous article located on our news page.

With all of the above to consider, it’s no surprise that your Income Tax bill may continue to rise as you climb the career ladder and/or draw an income from your pensions, savings, and investments.

As your earnings rise against frozen or reduced thresholds, you could face higher Income Tax

While Income Tax bands remain frozen for now, a large proportion of workers are asking for pay increases to cover rising costs. If you’re one of them, your earnings could be increasingly vulnerable to Income Tax.

Remember, inflation spiked during the height of the pandemic, reaching a peak of 11.1% in October 2022 before slowing again. The Office for National Statistics (ONS) reported an inflation rate of 2.5% as of December 2024, but UK consumers are still feeling the effects of the previously higher rates.

What’s more, the National Living Wage is going up by 6.7% in April 2025, and the ONS says that in the year to January 2025, weekly employee earnings growth stood at 5.6%.

Retirees aren’t necessarily safe from rising Income Tax either.

The State Pension is also set to rise in April, under the triple lock system that sees payments rise by the higher of inflation, wage growth, or 2%. In 2025, the full new State Pension will increase by 4.1%.

Combined with funds drawn from your private pension(s), which may be rising in value the longer they’re invested, you could see your retirement income eroded by Income Tax.

So, whether you’re earning a salary or drawing a retirement income, it’s important to pay attention to how much Income Tax you’re paying and explore strategies to mitigate it where possible.

How to mitigate Income Tax for earners and retirees

Earners

If you’re still working, you could:

- Enter a salary exchange agreement with your employer. This usually involves your employer paying a portion of your salary towards a pension scheme, car lease, childcare vouchers, or a similar perk, reducing the Income Tax due on your take-home pay. There are downsides to this arrangement too, as lower take-home pay could affect your mortgage eligibility and affect some state benefits. You will need to speak to your employer to see if they offer salary sacrifice arrangements and it’s advisable to seek professional advice before proceeding.

- Declare allowable expenses on your tax return. For self-employed earners, mitigating Income Tax comes down to self-assessing correctly. Make sure to claim all allowable expenses against your tax bill to maintain tax-efficient earnings.

These measures might help you earn a tax-efficient income while you’re still working.

Retirees

If you’re already drawing from your private pension and/or receiving the State Pension, it is crucial to be aware of how much tax you will pay on your earnings.

Firstly, make sure you are aware of how much tax-free cash you can take from your pension and form a strategy for drawing this either as a lump sum or in the form of multiple withdrawals. This way, you won’t be in for a surprise when faced with an Income Tax bill on your remaining pension income.

Then, make sure you’re factoring in other forms of income, including the State Pension, final salary pension payments, rental property income, and any earnings from part-time work you undertake in retirement. All these, when combined, may incur a higher bill than you expect.

Bespoke financial planning may help you hit the tax bullseye

Although your Income Tax bill may be rising, that doesn’t mean you are powerless. Working with a bespoke financial planner can help you “hit the bullseye” and avoid overpaying now and in the future.

Email info@depledgeswm.com or call 0161 8080200 to find out more.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

The Financial Conduct Authority does not regulate tax planning.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). Your capital is at risk. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available.

Your pension income could also be affected by the interest rates at the time you take your benefits. The tax implications of pension withdrawals will be based on your individual circumstances, tax legislation, and regulation, which are subject to change in the future.