14/11/2024

Here at Depledge, we strongly advocate for our clients taking control of their finances, and this includes preparing for unexpected circumstances.

If you know a loved one who has been diagnosed with Alzheimer’s disease, the leading cause of dementia in the UK, you will know that this illness can be extremely detrimental to a person’s quality of life. As you might be aware, dementia usually involves a gradual decline in cognitive processing that affects memory, speech, and a person’s ability to take care of their own wellbeing.

The NHS reports that 1 in 11 over-65s has dementia, and that by 2030, it expects more than 1 million people to be living with this illness. What’s more, the Alzheimer’s Society estimates that dementia is one of the most expensive diseases to provide care for – and nearly two-thirds of the costs are shouldered by those with dementia and their families.

While these statistics may scare you, there are concrete steps you can take to financially prepare for the potential eventuality of developing this cognitive disease.

Keep reading to discover how you and your family could plan ahead in case of a future dementia diagnosis.

Register both types of Lasting Power of Attorney

A Lasting Power of Attorney (LPA) allows you to designate a nominated person or people, your “attorney(s)”, to make decisions on your behalf.

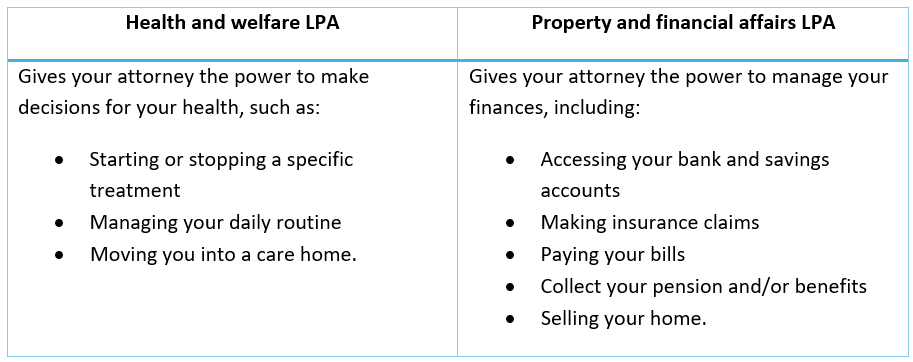

There are two types of LPA.

Having both forms of LPA in place means that if you were diagnosed with dementia or a similar cognitive illness, a trusted person is on hand to help you make important choices. This could be your spouse, adult child, sibling, or trusted friend – someone you know will act in your best interests.

When named in your property and financial affairs LPA, your attorney can start managing your money even before you lose full mental capacity. It’s up to you how and when they step in. And, when you lose capacity, your health and welfare attorney can begin to make care decisions with your wellbeing in mind.

Crucially, you can’t register either type of LPA once you have already lost mental capacity, or in other words, the ability to make your own decisions. So, if you want to prepare in case you do develop dementia, it’s worth registering your LPAs as soon as possible.

You can speak to your financial planner about the importance of LPAs – or you can head straight to the government website to register yours.

The Financial Conduct Authority does not regulate Lasting Powers of Attorney.

Designate a portion of your savings for later-life care

As you read earlier, dementia care can be expensive, especially in the late stages of the disease, at which point individuals sometimes need round-the-clock assistance.

What’s more, unless you qualify for continuing healthcare (CHC) under the NHS, which provides unlimited care free of charge but is difficult to come by, you might need to pay for your own care.

As of the 2024/25 tax year, both at-home and residential care is means-tested as follows:

- If your total capital (including the value of your home) is worth more than £23,250, you will be required to pay for all your own care.

- If your capital stands between £14,250 and £23,250, you may need to pay for a portion of your own care, applied on a sliding scale depending on how much wealth you hold.

- Those with total assets worth under £14,250 won’t need to pay for their own care.

With this in mind, it’s likely you would need to pay for your own care if you were diagnosed with dementia. While these rules are subject to change in future, as it stands, it may be worth starting to put funds aside.

Indeed, even if you do not develop dementia, research published by Fidelity now estimates that 3 in 4 adults alive today will need some form of later-life care. As of July 2024, Age UK reports that it’s around £800 a week for a place in a residential care home and £1,078 a week for residential nursing care.

Here are tips for setting money aside:

- Use cashflow modelling software to model how much you can afford to lay aside (your financial planner can help with this)

- Ensure you’re saving or investing the money efficiently, giving it the greatest chance of growing in line with rising care costs

- Talk to your family and your attorney about where the money is located and for what purpose (for instance, if some of the wealth is tied up in your home, your attorney may need to sell your home to pay for care).

Starting this process early in life could help you afford the care you need more easily, if the time comes.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested.

Ensure you have the appropriate protection in place

If you were diagnosed with a long-term illness like dementia while you’re still earning, this would likely have a significant impact on your financial circumstances. Similarly, needing care in retirement could deplete your savings and investments faster than you had anticipated.

As such, ensure you have the appropriate package of protection in place. This may include:

- Life insurance. If you are considered terminally ill, some forms of life cover may offer an early, tax-free payout to help your family cover immediate costs.

- Critical illness protection. Critical illness protection offers a one-off lump sum for those diagnosed with an eligible illness, or who become critically injured. Having this protection in place could reduce your family’s stress if you were diagnosed with dementia.

- Income protection insurance. This is similar to critical illness cover, but instead of a one-off payment, income protection offers ongoing payments of up to 60% of your usual income. With these payments, your family may be able to cover the essentials, like your mortgage, without using your savings or investments.

Taking out cover while you’re young and healthy could lessen the amount you pay on a monthly basis and may offer financial peace of mind if you’re worried about becoming ill in future.

Note that life insurance plans typically have no cash in value at any time and cover will cease at the end of the term. If premiums stop, then cover will lapse.

Form a relationship with an experienced financial planner

We understand that all this information, and the prospect of becoming ill, may be overwhelming. Luckily, you don’t need to take this on alone.

Our financial planners will invest time into forming a long-term relationship with you, your family, and the attorney(s) named in your LPAs. Financial planning is about so much more than money – it’s about knowing that when you need help making important decisions that may affect your quality of life, a professional is on your side.

Whether you have a loved one who is elderly or ill, or you want to financially prepare for this potential eventuality yourself, talk to our team today.

Email info@depledgeswm.com or call 0161 808 0200.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All contents are based on our understanding of HMRC legislation, which is subject to change.

Comments on Are you worried about dementia? Here’s how to plan ahead

There are 0 comments on Are you worried about dementia? Here’s how to plan ahead