19th October 2021

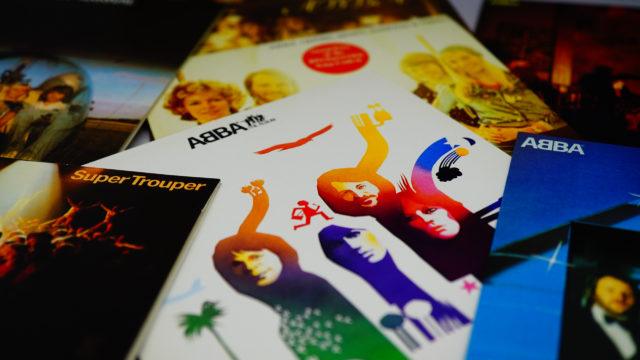

Whether you grew up with their songs dominating the charts, or your first exposure was the musical Mamma Mia, ABBA have been part of the UK’s cultural landscape for almost half a century.

Originally formed in 1972, the foursome of Agnetha, Anna-Frid, Bjorn, and Benny recently announced an unexpected reunion, with their first album of new material in almost 40 years.

New single ‘Don’t Shut Me Down’ made the UK top ten, while the band also announced a London concert residency featuring motion capture digital avatars of the band.

So, to celebrate the return of one of the biggest pop acts of all time, here are seven things ABBA can teach you about financial planning.

1. The importance of budgeting

Where better to start than the band’s 1976 top three single ‘Money, Money, Money’? As Anna-Frid sang:

“I work all night I work all day/To pay the bills I have to pay/Ain’t it sad?

“And still there never seems to be/A single penny left for me/That’s too bad.”

Budgeting is the cornerstone of financial planning. You must understand the income that’s coming in, and how much you have going out (and where it’s going) before you can make any plans.

Regularly reviewing your budget also enables you to make savings where appropriate – for example, by cancelling direct debits for services you don’t need, and shopping around for financial products such as insurance.

It doesn’t just have to be a “rich man’s world”!

2. Align your investments to your risk tolerance

As Agnetha sang, it can pay to “take a chance, take a chance, take a ch-ch chance.”

In the long term, investing your money typically provides a better return than keeping it in cash.

Of course, investing is all about aligning your money with your goals and your tolerance for risk. It’s for longer-term saving (more than five years) and, of course, the value of your investment can go down as well as up and you may not get back the full amount you invested.

3. It’s time in the market, not timing the market that counts

Imagine ABBA is a corporation with shares. You bought your initial ABBA shares in 1972 when the group formed.

In 1974, you’d probably have made a tidy profit as the quartet won the Eurovision Song Contest and ‘Waterloo’ went to number one across the continent. You’d then maybe have sold your shares a year later as their follow up single limped to number 38 in the UK charts.

Had you sold, you’d then have missed six years of pretty much solid growth, as a catalogue of million-selling hits dominated the charts.

Then, in 1982, it all went quiet. ABBA never officially split, but you might have sold your shares in the late 80s and cashed in your profit.

Then, in 1992, British group Erasure released their Abba-esque EP, featuring cover versions of four popular ABBA hits. Suddenly, the Swedish band were popular again, and, later that year, the ABBA Gold greatest hits album was released and went on to become the second-biggest selling album in British chart history.

Again, you might have decided to cash in your profits in the mid-90s. You’d have then missed out on another resurgence after the stage and film musical Mamma Mia – the 13th biggest film in UK box office history.

The point here is that it would have been almost impossible to predict when ABBA’s fortunes would rise or fall over the last 50 years. If you’d taken the profit in 1991, you’d have missed the ABBA Gold bounce. Had you sold in 2019, you’d have missed the “new album and concert experience” bounce.

Many experts say that it’s time in the market that counts. This means being patient, and letting your investment play out over the long term.

4. The important of having goals and ambitions for your future

As financial planners, we’re interested in how your money can help you to live the life you want. The important thing here is that we start with your goals, not with your money. Only by establishing what you want to achieve with your life can we work out how your money can help you to get there.

As Anna-Frid sang in 1979:

“I have a dream, a fantasy, to help me through reality/And my destination makes it worth the while.”

5. Why you should involve your family in your financial planning conversations

Recently, you read about why it’s so important to include your family in your financial planning conversations.

It can help smooth the transfer of wealth, ensure no one has any nasty surprises, and manage your children and grandchildren’s expectations.

As well as including younger generations in your plan, we also recommended including your parents.

Inheritance Tax issues that may concern you could also be worrying your parents. They may not know about the many tax exemptions they could be taking advantage of. And they may not be enjoying the life they could because they are worried that they will run out of money.

So, when thinking about your intentions, ask yourself this question: “Does your mother know?”

6. The importance of protection

While Agnetha may have been singing about the end of a relationship in ‘The Winner Takes It All’, she could equally have been referencing the death of a loved one:

“The gods may throw a dice/Their minds as cold as ice.

“And someone way down here/Loses someone dear.”

Putting the right protection in place ensures that an injection of capital (or income) is available when you most need it. This might be on death, or on illness or injury. It ensures that you and your family have one less thing to worry about at what is likely to be a stressful and emotional time.

7. Work with an expert

Financial planning adds value. A landmark report from the International Longevity Centre found that receiving professional financial advice between 2001 and 2006 resulted in a total boost to wealth of more than £47,000 in 2014/16.

There are also many non-financial benefits of financial advice, from peace of mind to feeling more confident and in control.

In ABBA’s 1979 hit ‘Voulez-Vous’ they share the sentiments of many of our clients:

“I’m really glad you came, you know the rules, you know the game/Master of the scene.”

As the 2021 Retirement Adviser of the Year, we’re ideally placed to help you live the life you want to. Which, after all, is the name of the game.

Get in touch

To find out how we can help you, please get in touch. Email info@depledgeswm.com or call 0161 8080200.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Comments on 7 things ABBA can teach you about financial planning

There is 1 comment on 7 things ABBA can teach you about financial planning

Comment by naujausi darbo skelbimai uzsienyje

Very interesting, thanks for sharing!