26th April 2021

In recent months, Brits have become a nation of savers. The Guardian reports we collectively put £17.1 billion into savings and deposit accounts in February, on top of the £18.5 billion we saved in January.

With shops, restaurants and theatres closed, and restrictions placed on movement, you may have seen your bank account balance rise month on month over the last year.

If you do now have surplus income, here are five suggestions for how to make the most of your extra pandemic savings.

1. Build up an emergency fund

The last year has taught us that unexpected events can happen at any time. To protect yourself against short-term disruption – whether that’s an illness, injury, a downturn in your business, or a period out of work – it’s vital to have an emergency fund in place.

The amount will be different for everyone, but a good rule of thumb is to keep three to six months’ salary available in an easy-access savings account. It’s there to ensure you have funds available if your car breaks down, you need a new boiler, or if sales drop and you need to navigate a tricky period.

If you have generated extra money in the last few months, consider putting some of it aside – you never know when you might need it.

2. Increase your pension contributions

Your pension is one of the most tax-efficient ways you can save for your future. Simply put, if you’re a higher-rate taxpayer then every £1,000 that goes into your pension only costs you £600.

If you have generated some spare savings during lockdown, then making an additional lump sum pension contribution, or increasing your regular contributions, is great for boosting your future wealth.

Remember that your Annual Allowance restricts the amount of tax relief you can generate on your contributions. The 2021/22 Annual Allowance is £40,000 (or 100% of your earnings if lower).

If you have already started flexibly accessing your defined contribution pension, then your Annual Allowance is likely to be just £4,000 – something to consider if you want to draw from your fund but still make pension contributions based on your earned income.

Remember that you typically can’t access your pension until you are 55 (57 from 2028), so it is often a long-term commitment. If you are likely to need your savings sooner, alternatives such as an ISA might be more appropriate.

3. Pay off expensive debt

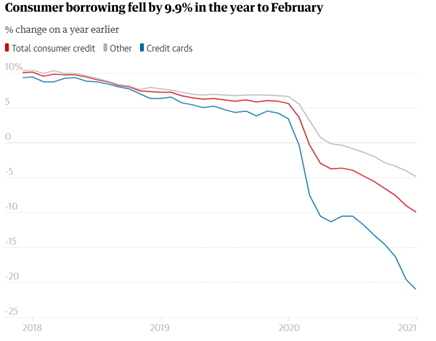

Not being able to eat out, holiday abroad, or go window shopping might have seen your bank balance rise during lockdown. One way that many Brits have used this spare cash is to repay their debt.

During February 2021, a total net balance of £1.2 billion was repaid to consumer credit accounts, on top of an average net repayment of £1.8 billion a month since the first lockdown in March 2020.

Source: Guardian

With savings interest rates at record lows, it can be financially beneficial to pay off more expensive debts.

Credit cards are a good place to start. Moneyfacts reports that the average credit card debt per household in the UK in October 2020 was £2,177.

On a credit card with a 21.95% APR and paying a monthly repayment of £77, it would take you three years and three months to clear the debt, which would have cost you £791.73 in interest.

If you have generated some spare income, consider repaying your most expensive debt first.

4. Put money aside for your children or grandchildren

When we’re chatting to clients about their future goals, and what financial aspirations they have for the future, putting money aside for children and grandchildren is never far from the conversation.

If you’ve generated some spare savings during lockdown, starting or boosting a nest egg for a child can be a good way of putting your cash to excellent use. Parents and grandparents can pay up to £9,000 into a Junior ISA in the 2021/22 tax year and you have the choice of a Cash or Stocks and Shares ISA.

While most Junior ISAs are in cash – around 70% – the fact that you might be saving for more than a decade means you could consider investing the money with the potential for long-term growth. Note however that stocks and shares investments do not afford the same capital security as deposit accounts.

If you want to think even more long term, it’s possible to start a pension for a child. Even though they are unlikely to have taxable earnings, you can contribute £2,880 into a child’s pension and benefit from a tax relief boost taking the total contribution to £3,600.

Remember they won’t be able to access this money until the age of 57 or more. So, if you want to help them with their education costs, or to get onto the property ladder, an alternative type of investment will be more suitable.

5. Gift from income

We’ve previously looked at ways that you can mitigate a potential Inheritance Tax bill – indeed you can download our useful guide on this subject.

If you find that you have surplus income each month, you can make gifts from your regular income. To fall outside your estate for Inheritance Tax purposes, these gifts must:

- Be made from your income (taking “one year with another”)

- Form part of your normal expenditure, so they should be regular in terms of value and frequency

- Enable you to maintain your normal standard of living.

If you plan to use this tax exemption, then it’s important you keep good records of the gifts to prove they have been regular and made from your income.

Get in touch

If you would benefit from advice on what to do with any surplus funds you have generated through lockdown, please get in touch. Email info@depledgeswm.com or call (0161) 8080200.

Please note

A pension is a long-term investment. The value of your investment (and any income from them) can go down as well as up which would have an impact on the level of pension benefits available.

Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor. The Financial Conduct Authority does not regulate Estate Planning.

Comments on 5 ways to make the most of your additional pandemic savings

There are 0 comments on 5 ways to make the most of your additional pandemic savings