14 March 2022

In the first three months of 2022, the stock market has proved volatile for investors all around the world.

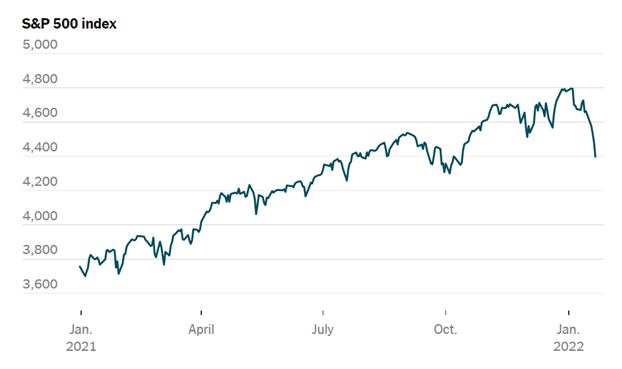

The continued concern surrounding the Covid-19 pandemic, the Russian invasion of Ukraine, supply chain disruptions, and the rising rate of inflation, have all caused turbulence in global markets. In the below graph, depicting the S&P 500 index for January 2021 to January 2022, you can see a sharp drop as we entered the new year.

Source: The New York Times

What’s more, the apprehension surrounding the world events in the first quarter of 2022 could continue to shake up the market as the year progresses.

Market volatility is like the tide – it ebbs and flows, and you can’t fight it, no matter how experienced you are. Instead, you could choose to have a positive outlook on these market fluctuations.

Read on to find out five positive ways to deal with market volatility.

1. Be patient

One of the first ways to deal with uncertainty is to be patient, as markets typically recover.

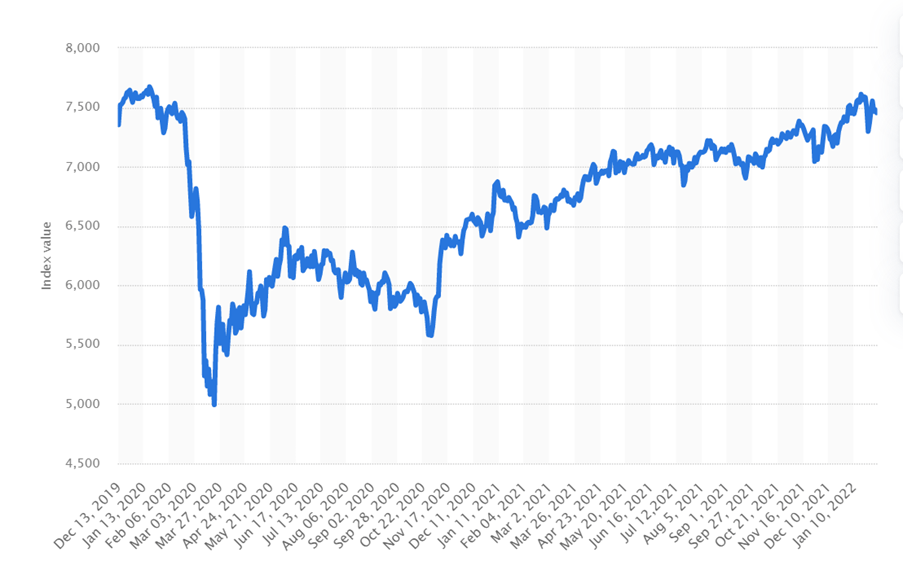

The below graph, published by Statista, shows the FTSE 100 index UK from December 2019 to January 2022. Here, you will see that, despite the downturn that occurred in March 2020 as the pandemic unfolded, the value of the FTSE 100 has climbed steadily back to almost pre-pandemic levels since then.

Source: Statista

Market volatility is a natural part of investing – after all, you wouldn’t invest in the first place if you didn’t think that market values might shift.

So, try to be patient and ride out the volatility your investments might be experiencing during the first quarter of 2022. Remember that investing is a marathon, not a sprint.

2. Try not to obsess over your portfolio by checking it daily

According to INVST, Americans alone check their phones a total of 8 billion times a day. All over the world, smartphones are an unavoidably important part of our lives, enabling us to work, communicate and celebrate with others.

Nevertheless, having access to the status of your investments all day every day could potentially become an issue if you don’t exercise self-control when it comes to checking your holdings.

It can be incredibly tempting to check the value of your portfolio obsessively every day. However, you’re likely investing for the long haul, and constantly checking your investments could lead you to make potentially damaging decisions. Just as you don’t check the value of your home every day, you shouldn’t feel the need to check the value of your pension or ISAs.

In fact, psychologically, keeping constant tabs on your investment wealth can trigger stress, causing potential sleeplessness, distraction and worry.

Normally, checking your portfolio a maximum of once a quarter could be beneficial – that way, you’re keeping tabs on your investments, without losing sleep over them on a day-to-day basis.

3. Don’t panic-sell after a dip in share prices

A typical mistake some investors may make after a fall in investment value is to panic-sell.

You might not want your assets’ value to fall even further, so you may decide to cut your losses and divest yourself of those investments altogether. However, this decision could mean you simply turn a paper loss into an actual loss.

It can be helpful to examine market volatility using a different analogy. For example, if the housing market crashed and the value of your home plummeted, would you immediately pack up and sell?

Of course not – you’re comfortable in your home and you know that, like most things, the housing market will recover. Applying this logic to your investments could help prevent you from panic-selling and regretting it later.

Moreover, studies have shown that panic-selling can lead investors to form a toxic relationship with the stock market and can even stop them from investing further. Research published by CNBC in 2021 showed that 30% of people who panic-sold shares during a 2015 market dip never re-entered the stock market.

So, it could be wise to stay calm and think rationally about market volatility, rather than acting fast and potentially regretting it later.

4. View market volatility as a potential investment opportunity

Instead of seeing market volatility as a problem you need to face, you could instead view it as a potential investment opportunity.

Other investors might panic-sell when the price of their investments decreases, giving you the chance to invest in assets that are likely to increase in value again over time.

This might seem counterintuitive, but by investing when prices have fallen, you could actually be making a smart investment choice that may prove lucrative in the future.

Market volatility is inevitable, so using it to your advantage could be a highly practical skill to acquire as an investor.

5. Focus on your long-term goals

When you begin feeling anxious about the state of your investments in a volatile market, it is important to remind yourself that, in 10 or 20 years, this periodical dip in the market won’t matter much to you.

The day-to-day fluctuations of your investments need not worry you if you know you aren’t going to be extracting money from your portfolio for another few years.

Focusing on your long-term goals can help soothe your mind as the markets go through phases of volatility.

Get in touch

If you are concerned about your investments and need professional guidance, please get in touch. Email info@depledgeswm.com or call 0161 8080200.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Comments on 5 positive ways to deal with market volatility

There are 0 comments on 5 positive ways to deal with market volatility