14 February 2023

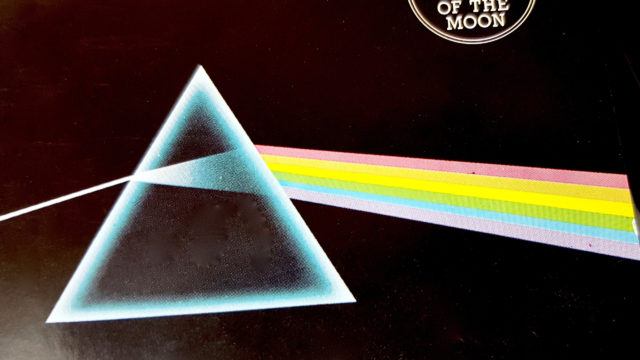

Pink Floyd’s Dark Side of the Moon – one of the top 50 best-selling albums of all time, selling 15 million units, according to Insider – turns 50 in 2023.

You might have fond memories of listening to this industry-shifting concept album as the years have gone by, but may not have realised how many life lessons it contains along the way.

Indeed, Dark Side of the Moon is not just, as one Rolling Stone reviewer put it in 1973, a “lush and multi-layered” feat of music genius – it also speaks honest truths about life’s true meaning.

Although you may never have connected the dots, Pink Floyd’s career-defining album has plenty of lessons to teach you about how you live your life, and in particular, how you manage your money.

So, here are three surprising things Dark Side of the Moon can teach you about financial planning.

1. ‘Money’ tells of the dangers of wealth obsession

We couldn’t make a list of Dark Side of the Moon tracks without including ‘Money’. This cynical song talks about money as “the root of all evil today” – so you might be wondering, “what on earth could this teach me about financial planning?”

Well, firstly, it’s understandable that money is something you think about a lot. After all, it funds your life, and any opportunity you want to pursue has to be paid for through the wealth you earn. As Pink Floyd say, you’ve worked hard all your life to “grab that cash with both hands and make a stash”.

While there’s nothing wrong with accumulating wealth and spending it on things you desire (“new car, caviar”), an obsession with wealth can lead you down a dangerous path.

A growth mindset is important to achieve your goals, but in fact, you could already be closer to them than you think. Constantly chasing “more” can be stressful, and perhaps unnecessary, if you already have enough to reach your dreams without hustling seven days a week.

So, Pink Floyd’s ‘Money’ could teach you about being smart when it comes to your wealth.

Working with a financial planner can help you avoid becoming controlled by your money.

Here at Depledge, we can:

- Use cashflow modelling software to work out how much is “enough” for you to achieve your lifestyle goals

- Help you work towards your wealth targets, and reduce your stress levels in the process

- Lend guidance on all things financial, so you can focus on the important things in life with your money working in the background.

Don’t let the ‘Money’ control you – work with us to create a financial plan that puts you in the driver’s seat.

2. ‘Time’ reminds you life is too short to procrastinate when it comes to your wealth

It’s easy to feel “life is long” when you’re young, but as Pink Floyd reminds us, “one day you’ll find 10 years have got behind you”.

Indeed, there may be life goals you’ve always put off, thinking you’ve got plenty of time for things to fall into place.

Whereas, the more ‘Time’ you give yourself to plan for your future, the easier it could be to see the results you want. After all, you only live once – so planning ahead can help ensure you tick those all-important life goals off your bucket list.

Here are some key life milestones your financial planner can help you make ‘Time’ for:

- Retiring at the age you want. Planning when and how you’d like to retire is a years-long process; leaving it too late can incur unnecessary stress and potentially mean you miss out on key tax breaks in the run-up.

- Helping the next generation thrive. This could include providing funds for a house deposit, paying for their dream wedding, helping them get the education they deserve, putting funds aside for grandchildren, and writing a will that passes your wealth on when your ‘Time’ is up.

- Travelling the world. You might have postponed your travel bucket list during your career years, but once you retire, seeing the world could be a priority.

Working with a planner can give you the ‘Time’ to enjoy your life while the well-oiled machine of your financial plan works in the background.

3. ‘Eclipse’ teaches us to trust the evidence in front of us

Investing is usually a fantastic way to grow your wealth, but it can also ignite supreme optimism in us – and without due diligence, optimism can lead to rash choices.

Investing can be an emotional thing, encompassing many of the aspects described in ‘Eclipse’ – “all that you love, all that you hate, all you distrust, all you save”. Worryingly, a survey by Magnify Money found that 66% of people polled had made an “emotional investment” they later regretted.

Over the years, savvy investors have cultivated common traits, including:

- Being decisive

- Having a long-term plan

- Seeing the evidence in front of them rather than being led down the garden path

- Avoiding speculation

- Working with experienced investment managers.

So, when growing your portfolio, working with a planner can help ensure you are engaging with evidence-led investing. Your vision should be crystal-clear, and without a professional by your side, it might be difficult to pinpoint your exact goals when building a unique portfolio led by “all that you see”, not just your emotions.

Investing in this way can mean “everything under the sun is in tune” with your financial plan. Don’t let your emotions ‘Eclipse’ your financial vision – work with us to ensure you stay on track to meet your long-term goals.

Get in touch

Want to take Pink Floyd’s advice with the help of an expert? ‘Speak To Me’ (us!) today. Email info@depledgeswm.com or call 0161 8080200.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Comments on 3 things Pink Floyd’s Dark Side of the Moon can tell you about effective financial planning

There are 0 comments on 3 things Pink Floyd’s Dark Side of the Moon can tell you about effective financial planning