02/09/22

Have you considered how you might meet the cost of care if you need it in later life?

If you haven’t, you’re not alone. While no one wants to consider needing help when they are older, new research from Canada Life has revealed that more than 7 in 10 (72%) over-60s have not thought about planning for later-life care.

This is despite the fact that most people will need some care in later life. Indeed, according to an official government report, “around 3 out of 4 adults over the age of 65 will face care costs in their lifetime”.

With the costs of care potentially running into tens of thousands of pounds, and limited support available from the state, here are three reasons why planning for care costs should be a key part of your financial strategy, and some steps you can take to achieve peace of mind.

1. You may be more likely to need care than you think

If you’re fit and healthy, you might assume that you won’t need any care when you are older. However, with life expectancies rising, the government estimate 3 in 4 over-65s will need care at some point in their life.

Of course, this might not necessarily mean moving into residential care – it might simply mean you employ someone part-time to help with household tasks.

When building a financial plan, it’s often sensible to assume that you will need to pay for some care in later life, whether this is a stay in a residential home or some assistance in your own home.

With the Royal College of Physicians warning that, by 2040, there could be more than 17 million people in the UK aged 65 and above and you can see the scale of the likely demand for care.

2. It could be more expensive than you realise

According to the Canada Life survey, 1 in 4 people have put off thinking about care because of the financial anxiety surrounding it.

The cost of later-life care will vary depending on your specific needs, but it could be more expensive than you realise.

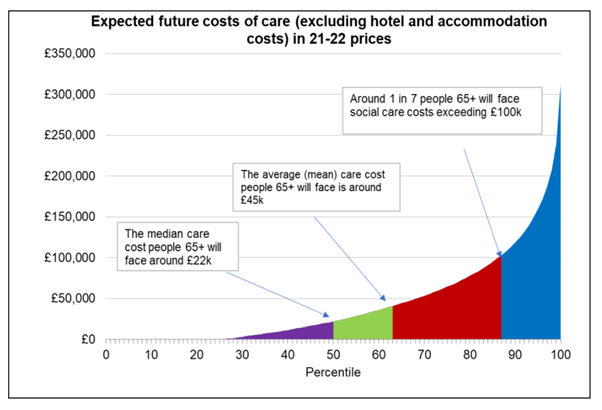

According to the government, 1 in 7 people will face care costs of more than £100,000, excluding hotel and accommodation costs, while roughly 1 in 10 individuals will face care costs above £120,000 over their lifetime.

Source: UK government

As you can see from the above, even the average cost of care for over-65s is £45,000 so, if you are married or have a partner, you can expect to need almost £100,000 to pay for any assistance you might need in later life. And, as the chart shows, it could be much more.

In separate analysis, when asked how they would pay for care, Canada Life reported that the over-60s they questioned said:

- 27% would use the State Pension

- 25% would use cash savings

- 18% would use a private pension

- 14% would sell assets (for example, their home)

- 13% expected the government to meet the cost

- 9% said they would release equity from their home.

We can help you to establish how much you might need and, using cashflow modelling, we can also help you work out how you would meet the cost of care in the future should that need arise.

3. You may get less help than you expect

In September 2021, the government unveiled its long-awaited social care plan for the UK. One of the headlines was a cap which will, for the first time, limit the amount of money people will have to pay towards meeting their eligible care and support needs in their lifetime.

The cap will be set at £86,000 in October 2023.

While this measure will limit the total amount you have to pay for care, it’s important to remember that the cap only includes the care costs themselves (such as washing or eating) and excludes any “hotel costs” such as accommodation and meals

According to Metro, those costs could come to an additional £20,000 a year.

So, putting aside £86,000 and assuming it is all you will ever need to cover your care could be insufficient, when these other costs are considered.

In addition, many people will never reach the cap at all and will receive no help.

According to carehome.co.uk, a care home search and review website, the average monthly cost of residential care in the UK is £2,816 (£33,792 a year) while the average monthly cost of receiving nursing care in a care home is £3,552 (£42,624 a year).

With the Metro reporting that the average life expectancy for somebody going into care is two years, or one year if you’re going into nursing care, for many people it will be unlikely their costs will ever be “capped”.

Planning now can give you the peace of mind that you will be able to afford the care you need

Worryingly, Canada Life found that nearly 1 in 10 people do not think it is their responsibility to think about their care needs, and they believe the state or a family member should pick it up.

While the social care cap will come into force in October 2023, you may still have to meet care costs up to the £86,000 cap and, as you read above, the total cost could even exceed that amount.

Planning now can give you the peace of mind that you’ll have the resources to meet future care costs.

Canada Life found that a quarter of over-60s are actively saving and building up investments to pay for it, 14% are actively budgeting, while 1 in 10 have already finalised their care plans.

Get in touch

If you’d like to build a financial plan that ensures you can meet the costs of any future care you may need, please get in touch.

Email info@depledgeswm.com or call 0161 8080200.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Comments on 3 practical reasons you need to plan for later-life care costs

There are 0 comments on 3 practical reasons you need to plan for later-life care costs