3 lessons about retirement you could learn from the Olympics and Paralympics

11 September 2024

If you’re a sports fan, the summer of 2024 has provided plenty of amazing opportunities to see truly excellent athletes competing to reach the top of their game. The Olympic and Paralympic Games have run between July and September, giving viewers the chance to see sportsmanship at its absolute best.

One interesting study that emerged during the Olympic Games was that, according to YouGov, one-quarter of Brits believe they could qualify for LA 2028 if they began training today. Most fancy their chances at a shooting sport, while 10% said they could qualify to play Olympic badminton and 7% believe they could become a rower.

It’s easy to imagine becoming proficient at a sport if you had four solid years to train towards this goal. But the truth is, four years is simply not enough time to become an Olympic athlete if you’re starting from scratch.

Here at Depledge, we recognise a similarity between those who believe they could train for the Olympics in just four years, and those who only start thinking about retirement in their 50s. While better late than never, it could be much more difficult to achieve your desired outcome in such a short time frame.

With this in mind, continue reading to learn three lessons Olympic and Paralympic athletes could teach you about retirement.

1. Starting as early as possible may put you in a good position for success

While there are some Olympic athletes who started training in their chosen sport later in life, most began as children.

Take Tom Daley, the British diving champion. He began diving competitively at just seven years old. Champion swimmer, Adam Peaty, was sent to regular swimming lessons at the age of four to help him overcome his fear of water. Dutch Paralympian, Diede de Groot, began her wheelchair tennis career at the age of seven, honing her skills over 10 years before “going pro” at age 17.

Looking at these athletes’ lengthy sporting careers through the lens of retirement, it’s safe to say that saving and investing as early as possible could yield the most consistently successful results.

If you have a child, you could save and invest on their behalf within a child pension and help them to reap the rewards of long-term returns.

The maximum amount you can pay into a child pension annually is £2,880 plus basic-rate tax relief, bringing the amount up to £3,600 as of the 2024/25 tax year.

Here’s an example of the benefits of long-term investing from interactive investor: if you paid the maximum sum into a child pension the year that your child was born, this money would be worth nearly £72,000 when the child is 60 (assuming a 5% annual return). If the money saw a 7% annual return, the pot would stand at £237,100 after 60 years.

Similarly, if you begin planning for retirement as an adult, you’ll likely benefit from doing so earlier in life rather than starting in your 40s or 50s.

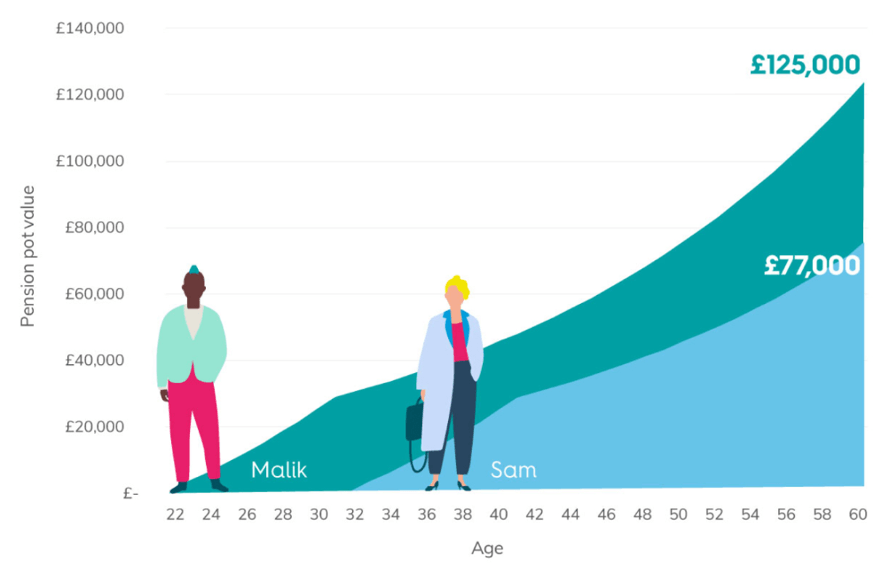

For instance, the below graph depicts two people who make equal pension contributions over a 10-year period. But Malik contributes between the ages of 22 and 32, whereas Sam pays in between the ages of 32 and 42.

Source: Nest

Assuming a 5% annual return until the age of 60, Malik, who began investing at 22, has a pot worth nearly £50,000 more than Sam, despite them both contributing the same amount overall.

These figures are for illustrative purposes only and cannot be guaranteed.

Just like the Olympians and Paralympians who began training for their successful careers at a very young age, many successful retirement journeys begin early in life.

2. Just because you stumble, it doesn’t mean you’ll fall

Many of the world’s most successful Olympians have experienced setbacks they never expected.

Take Simone Biles, who is officially the most accomplished and successful gymnast of all time, with 11 Olympic medals and 30 World medals to her name. In the Tokyo 2020 Olympics, Biles was expected to trounce the other contestants, but experienced “the twisties” – a phenomenon in which gymnasts’ skills appear to revert and cause them to lose control – and decided to pull out of the competition.

It took Biles two years to recover from the twisties. Fortunately, she returned to the Paris 2024 Olympics and was awarded a silver medal for her floor routine. Speaking to the press after her success, she said, “A couple of years ago, I didn’t think I would be back at the Olympic Games.”

Just like for Biles, and many other Olympic athletes, life events can derail your plans. Divorce, the death of a loved one, or changing careers later in life might prompt you to reevaluate when and how you can retire.

However, much like athletes who have a difficult Olympics and return four years later to succeed again, changes to your plans shouldn’t mean that your retirement goals should be discarded altogether.

Creating a new strategy, in light of life events, could help you make confident strides towards the retirement you deserve.

3. Great results are almost never achieved alone

Olympic and Paralympic athletes do not achieve their success alone. They’ll have a team of coaches and healthcare professionals, as well as loving supporters like friends and family, helping to keep them in peak condition.

Similarly, you may be less likely to achieve a successful retirement without expert guidance. A financial planner can help to ensure you’re making the most of opportunities to contribute into your pension, claiming as much tax relief as possible, and investing outside of your pension too.

Get in touch

To find out more about tailoring an Olympic-level retirement plan with the help of a financial planner, speak to us today.

We’ll talk to you about your goals and work with you over the long term to make them a reality.

Email info@depledgeswm.com or call 0161 8080200.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.