3 interesting ways Covid has impacted retirement in the UK

10th November 2021

From the way we wash our hands to the shape of our working day, the pandemic has affected our lives in countless ways. Now, a major survey by interactive investor has asked more than 10,000 Brits to identify just how their retirement has been shaped by Covid-19.

The Great British Retirement Survey shines a light on the ways in which people either approaching or at retirement have changed their plans – both in positive and negative ways – in a response to the last 18 months.

Here are three of the main ways the survey found that Covid has impacted on retirement in the UK.

1. Many retired people have more wealth

During lockdown, a key focus for the government was supporting the income of millions of people across the country. Through schemes such as “furlough” and the Self-Employed Income Support Scheme, the chancellor handed out billions in support to those people unable to work.

On top of that, initiatives such as a £20 weekly uplift in Universal Credit also supported struggling households.

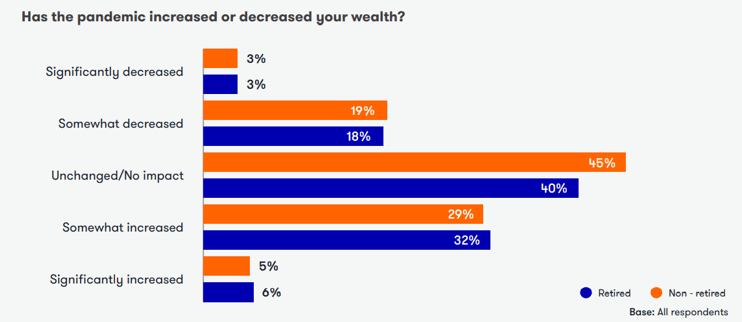

Despite this focus, the Great British Retirement Survey revealed that more people have seen their wealth increase during the pandemic than fall.

This was particularly true among retired people, where almost a third (32%) said their wealth had “somewhat increased” during the pandemic, compared to just 18% how said it “somewhat decreased”.

Source: interactive investor

There are several reasons for this. Firstly, despite some initial falls in the stock market, many global indices have recovered strongly with some, including the US S&P 500, hitting record highs. This has helped to boost the value of many portfolios.

Similarly, many millions of people were able to set aside a greater level of savings during lockdown.

If you are approaching retirement, then you may have saved a significant sum thanks to working from home. With no commuting cost and no temptation to buy goods and services when at work, the Guardian reports that households in the UK have managed to save about £190 billion since the start of the pandemic.

If you are retired, then you may have been unable to do many of the things you had hoped, from going away on holiday to eating out at your favourite restaurant.

While many households have increased their wealth during the pandemic, it’s important to acknowledge that not everyone has been a winner.

Even after markets recovered, many people still struggled to generate their required income because of companies slashing or cancelling dividend payouts.

Interactive investor report that, globally, dividends fell by over a fifth in the second quarter of 2020. 51 FTSE 100 companies, 115 FTSE 250 companies and 149 AIM-listed companies cut, suspended, or cancelled dividends in 2020, cutting off a vital income stream to many.

2. Poor market performance will change some peoples’ retirement plans

While many of the global stock market indices have returned to pre-pandemic levels, the Great British Retirement Survey did reveal that a significant number of people had changed their retirement plans because of Covid-19.

Of those respondents who had not yet retired, 1 in 10 said they would have to delay retirement, while a further 21% said they were not sure. Many of these said that this was because the pandemic had hit the value of their pensions, ISAs, and self-invested personal pensions (SIPPs).

Furthermore, nearly half (49%) of people who said they would need to delay their retirement said they would have to postpone for four or more years.

Additionally, a quarter (25%) said they were concerned that they would never be able to afford to retire, illustrating a serious impact on a significant minority of working people.

Uncertain market performance affected the retirement plans of a minority of people in other ways as well:

- 1 in 5 (20%) non-retired people (and 13 % of retired people) said they were more likely to need to work in retirement to make up for shortfalls

- 7% of non-retired (and 5% of retired) said they were more likely to buy an annuity to ensure a guaranteed income.

What these figures show is that the financial impact of the pandemic continues to reverberate for some people.

3. More people see retirement in a positive light

After almost two years of restricted liberty, it’s perhaps not a surprise that the research revealed that an increased number of people see retirement in a positive light.

Almost half (49%) of non-retired respondents saw retirement as a time of financial freedom and independence, up 14% from the previous year. 45% of non-retired people saw their retirement as “a life of pleasure”, up 6% in the last 12 months.

Additionally:

- More people saw retirement as an opportunity for new business or new hobbies

- Non-retired people appeared more optimistic about retirement, with more thinking life could improve (up 4% to 31%) or at least stay the same (up 7% to 44%)

- Some even had rosier expectations of how long they might live once they retired. 1 in 5 think they will live a further 30 or more years, while 38% hope for another 20 to 29 years.

Get in touch

It’s clear that attitudes to retirement have shifted over the last couple of years – both from a financial and an emotional perspective.

So, if your plans have changed, or you’ve decided you want to do things differently, we can help you put the financial plan you need in place to get there.

As the UK’s 2021 Retirement Adviser of the Year, we’re ideally placed to make your dream retirement a reality. Please get in touch to find out how – email info@depledgeswm.com or call 0161 8080200.

Please note

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future results.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts.