2018 proved to be a very difficult year in the markets with virtually all the major markets that we cover ending in negative territory

Andrew Day

What to consider before buying health insurance

Taking out health insurance is a big financial commitment. However, private healthcare is an attractive option to some because it allows you increased choice, private hospitals, reduced waiting times and more personalised care compared to free NHS treatment.

Long read: 10 years on from Lehmans and what has the financial services sector learnt?

The financial crash after the Lehman Brothers collapse saw the biggest global monetary crisis since the end of WW2. It led to a lost economic decade for many – average incomes in the UK still languish far behind their 2008 peak.

Funding care home costs with a care home ISA

If you’re under 60, funding your future care might not be top of your agenda. Garden improvements, good restaurants and holidays probably rank slightly higher, as well as saving for your pension if you’ve not yet retired.

4 top tips to protect yourself against pension scammers

You may well have seen the headlines that victims lost an average of £91k each in pension scams last year. Worryingly, in a recent survey, 32% of pension holders aged 45-65 said they were unsure how to verify if they were speaking to a genuine pensions adviser. Scammers are becoming increasingly sophisticated. They can be […]

Ideas for October half term

Incredible, isn’t it? It seems only a few week since the kids went back to school and already October half term is approaching.

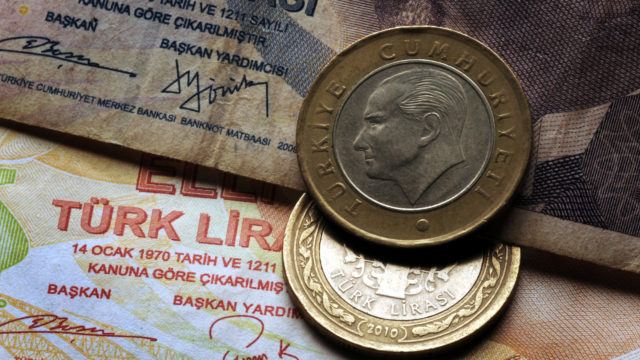

Is recent instability a cause for alarm for emerging market investors?

Over the last two decades, emerging markets have been attractive to investors and investment strategies have followed an ever globalising trend.

October 2018

On Tuesday, 3rd November 2020 the United States will go to the polls to elect its next President. All the indications are that Donald Trump will stand for a second term and if the words of Bill Clinton – “It’s the economy, stupid” – are to be believed, he will win.

4 key ways to prevent your grown-up children derailing your retirement savings

The Bank of Mum and Dad is a well-known concept and we all hate to see our children struggle financially, which is why many parents continue to support their children well into adulthood.

The rise of ‘staycation’ buy-to-lets

Since the Brexit vote, ‘staycations’ have become increasingly popular. This is unsurprising – for many people, going to the bureau de change has become an uncomfortable experience of seeing their hard-earned pounds transformed into a pitiful equivalent of euros or US dollars.