19th October 2021 On 7 September 2021, the prime minister, Boris Johnson, announced the government’s plans to pay for proposed social care reforms and increased NHS funding in England. The most notable announcements included a new Health and Social Care Levy on employment income alongside an increase in the rates of Dividend Tax. These two […]

Andrew Day

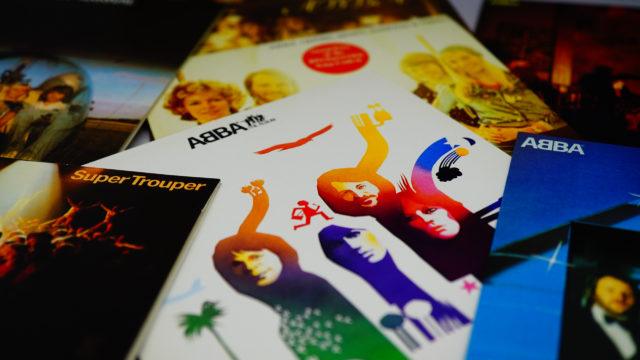

7 things ABBA can teach you about financial planning

19th October 2021 Whether you grew up with their songs dominating the charts, or your first exposure was the musical Mamma Mia, ABBA have been part of the UK’s cultural landscape for almost half a century. Originally formed in 1972, the foursome of Agnetha, Anna-Frid, Bjorn, and Benny recently announced an unexpected reunion, with their […]

Why you should include your children (and parents) in your financial planning conversations

14th September 2021 Discussing personal finances can be a tough conversation for many people. It can be a stressful topic to face, particularly with your loved ones. Perhaps it’s embarrassing, fills you with anxiety, or simply makes you feel uncomfortable? In 2019, Lloyds Bank conducted a survey and found that half (50%) of UK adults […]

Parents underestimating student debt by nearly 50%

14th September 2021 The recent record A-Level results saw 44.3% of entries obtain a grade A or above. This terrific success means that more than 210,000 18-year-old students in England have had their university places confirmed already. Heading off to university can be a fulfilling and enriching experience – but these days it doesn’t come […]

Guide: Leaving an inheritance vs gifting during your lifetime

8th September 2021 Have you thought about how you’ll pass wealth on to those who are important to you? Traditionally, this has been done through inheritance, but it’s becoming more common to gift during your lifetime. Our latest guide explains why more families are choosing to gift during their lifetime and the pros and cons […]

Why planning for your death is one of the best gifts you can give your loved ones

18 August 2021As strange as it may sound, planning for your death isn’t really about you. In reality, your estate planning is about your family. It’s your chance to make decisions that safeguard your wealth for your children, grandchildren, or anyone else you want to have it. It’s also an opportunity to help deal with […]

The guide to later-life planning and care

16 August 2021When you think about your future, how far ahead do you plan? Perhaps you’ve thought about what your life will look like in 10 years, but have you considered your later years? While retirement planning is common, it’s often the early years of retirement that people focus on. However, your needs and lifestyle […]

The minimum pension age will rise to 57 in 2028 – what does it all mean?

22 July 2021 7 in 10 adults don’t know that the government intends to increase the minimum pension age from 55 to 57. If you’re one of these people, read on to find out how this change could affect you. The normal minimum age you can currently access your pension is 55 but, in April […]

Guide: The history of investing and what you can learn from the past

28th June 2021Investing has been around for centuries and the basics haven’t changed as much as you might think. Technology has changed how we invest, but some of the investment lessons from the past are just as relevant today as they were in the 1600s. Our latest guide looks at the foundations of modern investing, […]

5 things Covid has taught us about having a rainy day fund

10th June 2021 The last 18 months have reminded us that unexpected events can happen at any time. From mundane issues such as your car breaking down to life-altering illness or redundancy, you’re never quite sure when you’ll be blindsided by something out of your control. One of the ways to achieve financial security is […]