16 April 2025

If you follow the financial news, you may already be aware that the first quarter of 2025 was a mixed bag for the stock market and world economy.

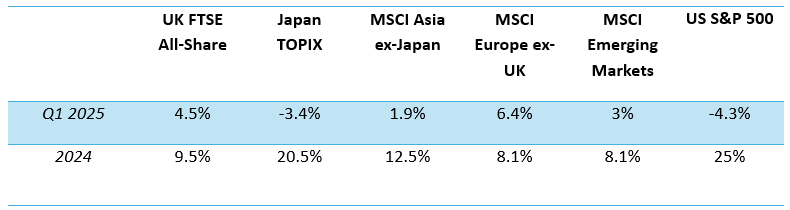

Below is a table demonstrating the performance of six key world indices in Q1 2025 and in the previous year.

Source: JP Morgan

As demonstrated above, while equities in Europe, the UK, and emerging market nations performed positively, Asian markets saw meagre returns, and Japanese and US indices declined.

Keep reading to discover the factors that led to these market movements and other economic news from four key regions.

UK

The first three months of 2025 saw the UK FTSE All-Share rise by 4.5%, a positive result considering the market movements occurring in the US and elsewhere.

In part, UK investments may have been bolstered by the potential implementation of US tariffs being implemented on the European Union, Asian nations, Canada, and Mexico. What’s more, at the end of the quarter, the chancellor’s Spring Statement brought relief to some consumers and investors who were concerned about additional tax levies that did not materialise.

Although UK equities performed well, stagflation (a declining or stagnant economy combined with rising inflation) could still be on the horizon.

The UK economy declined in January, the Office for National Statistics (ONS) reports, while inflation rose by 3%. The Bank of England (BoE) halved its growth forecast for the year and predicted that inflation may rise this year, then return to the BoE’s target of 2% by 2026.

Read more: Stagflation: The Bank of England’s latest alert explained

US

Market movements in Q1 were influenced almost entirely by the new government’s decision to place tariffs on imports of certain goods from certain countries. Investors clearly became cautious due to the daily changes to these policies leaving even leading experts unsure of what the future holds.

As a result, the S&P 500 saw a 4.3% decline in Q1, a poor performance compared to its staggering 25% return across 2024.

Due to the volatility of the situation, the Federal Reserve (Fed) took no action regarding interest rates in Q1, keeping the central rate of interest fixed at 4.25% – 4.5%, Trading Economics reports. CNBC reports that economic growth was just 0.3% in Q1.

All said, it is important not to become spooked by the short-term volatility the US market is experiencing. Political events often have an impact on returns, but historically, this has not prevented equities from rising steadily in value over the long term. Our view continues to be that remaining invested and staying the course is likely to be the right course of action.

Read more: Should you always “buy the dip”?

Eurozone

The eurozone was the best-performing region in Q1. Schroders attributes some of this success to the launch of Chinese artificial intelligence (AI) model, DeepSeek, in January, which caused European investors to “rotate away” from concentrated investing in US large-cap tech stocks. Meanwhile, the German general election in February boosted investor confidence, with Friedrich Merz’s leadership sparking hopes of a “pro-growth agenda”.

Of course, threats of tariffs placed on certain eurozone exporters, particularly automakers, may have caused some disturbance.

But on the whole, this region appears to have thrived in Q1. The European Central Bank (ECB) cut its interest rates in January and March, and inflation in the region fell from 2.5%, to 2.3%, to 2.2%, in January, February, and March respectively, Eurostat reports.

Asia

With much of the tariff pressure being placed on China, Asian markets experienced volatility in Q1 2025.

The Japan TOPIX index fell by 3.5% over the quarter, with Schroders reporting that this was largely due to pressure on equity markets in the region due to US tariff policies.

In China, despite tariff volatility, the launch of DeepSeek strengthened equity markets, with many investors diversifying their technology holdings after seeing its success.

It is yet unclear what tariff policies and other important events will do for Asian markets – stay tuned for our Q2 market update in July.

Speak to us about safeguarding your investments

We understand that your investment portfolio is a hugely important part of your financial plan. So, speak to us about safeguarding your investments and making your portfolio work for you.

Email info@depledgeswm.com or call 0161 8080200.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Comments on Q1 2025 global market update

There are 0 comments on Q1 2025 global market update