14/11/2024

On 30 October 2024, Rachel Reeves became the first woman to deliver a Budget to parliament.

A much-anticipated event, Labour’s first Budget since being elected in July promised “difficult decisions” to fill the “£22 billion black hole” the chancellor says was left behind by the Conservative Party.

As expected, this historic Budget saw changes to fiscal policy across the board, affecting business owners, farmers, investors, carers, workers, and retirees.

One important change Reeves enacted in her Budget had to do with the UK’s Inheritance Tax (IHT) regime. Previously labelled Britain’s most hated tax, the chancellor said IHT is levied on approximately 6% of UK estates, reducing the amount some beneficiaries receive when a loved one dies.

Keep reading to discover how changes to IHT announced in the 2024 Autumn Budget could affect your family’s wealth in the future.

Labour has extended the freeze on Inheritance Tax nil-rate bands until 2030

In her speech, the chancellor stated she was taking a “balanced approach” to IHT, reassuring the public that she understands the “strong desire to pass on savings to children and grandchildren”.

First, Reeves announced that the nil-rate bands, fixed at their current rates until 2028 by the Conservatives, will now be frozen until 2030.

As you might already know, the nil-rate bands are tax-efficient thresholds under which you can pass on assets tax-free when you die.

As of 2024/25, the nil-rate band stands at £325,000. The additional residence nil-rate band offers a further relief of up to £175,000 to those passing their main residence to direct descendants.

So, if you passed away and left your home, investments, and cash to your children, the first £500,000 they inherit would not normally be subject to IHT. Assets that surpass the nil-rate bands would usually be subject to IHT at a rate of 40%.

Remember, the nil-rate bands are individual, and at the time of writing, you won’t pay IHT when inheriting your spouse or civil partner’s estate. And, if your spouse passed away and left you their entire estate, their unused nil-rate bands would be added to your own, meaning that you could then pass on up to £1 million tax-free to the next generation when you die.

All this to say, you can still accumulate and bequeath a substantial amount of wealth before IHT is due.

However, the extension of the nil-rate band freeze could drag a greater portion of your wealth into the taxable bracket. If the value of your home, investments, and other assets continues to rise until 2030, they are more likely to surpass the nil-rate bands that won’t be rising alongside them.

This is already evident from HMRC’s IHT receipts, seeing as the nil-rate band has remained the same since 2009, and the residence nil-rate band has not risen since 2020.

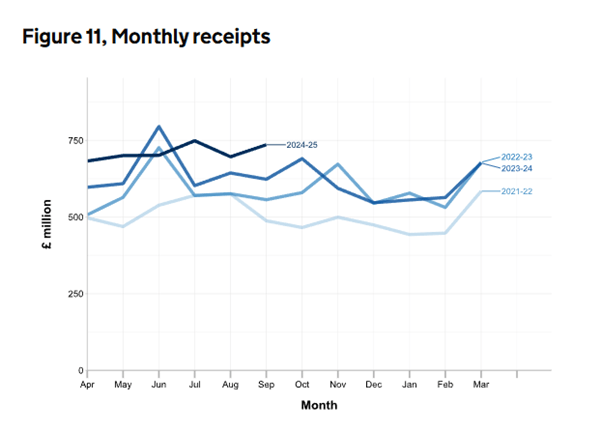

The below graph demonstrates HMRC’s IHT takings in each tax year from 2021/22 until September 2024.

Source: HMRC

HMRC reports that between April and September 2024, estates paid £4.3 billion in IHT – £0.4 billion more than was paid in the same period in the previous year.

Reeves’ freeze of the nil-rate bands could only continue to pull more estates into the IHT bracket.

Pensions will form part of all estates for Inheritance Tax purposes from April 2027 onwards

If you passed away today, your pension would not form part of your estate for IHT purposes.

This means that you could leave a large amount of pension wealth behind without any tax being applied, giving your beneficiaries’ inheritance a helpful boost.

However, in the Budget, Reeves announced that from 6 April 2027, pensions will be included within the IHT net. So, on top of your properties and other assets, any inherited pension wealth will also be included within the value of your estate, and IHT may be applied accordingly.

Together with the nil-rate band freezes, the inclusion of pensions could put your wealth at greater risk of being taxed upon your death.

Inheritance Tax rules have changed regarding Agricultural Property Relief and Business Property Relief

Under existing rules, Agricultural Property Relief (APR) was applied at a rate of 100% to those passing down farmland and farming business assets to the next generation. Essentially, this means that most farming businesses can pass their assets to the next generation free of IHT.

However, Reeves announced that from 6 April 2026, only the first £1 million will receive APR, while the remaining value of these assets will be subject to IHT at a reduced rate of 20%. The regular nil-rate bands apply in addition to APR, meaning that technically, an individual could pass down £1.5 million in agricultural assets and business property IHT-free.

Similar to other IHT rules, a farm owned by two people can effectively double this relief, bringing the tax-free amount a couple can bequeath to £3 million from April 2026.

Plus, the chancellor reduced the rate of Business Property Relief (BPR) from 100% to 50%, for shares designated as “not listed” on the markets of a recognised stock exchange, such as the AIM.

Bespoke financial planning can help you adapt to fiscal policy changes

Last month, we published our insights into why having a strong mindset and working with a financial planner could help you adapt to changing fiscal policies.

Today, that message rings true. Although some of the chancellor’s announcements may be detrimental to your family’s wealth, focusing on your personal goals and adapting to the situation is of paramount importance.

Here at Depledge, our services could help you:

- Review your estate plan in light of the chancellor’s IHT announcements

- Consider strategies that could help to reduce the value of your estate before your death

- Create a bespoke plan that takes all the Budget announcements into consideration.

We’re here to support your family’s financial goals no matter how the UK’s fiscal landscape changes.

Get in touch

To speak to an independent financial planner about IHT, or any other financial matter, email info@depledgeswm.com or call 0161 8080200.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All contents are based on our understanding of HMRC legislation, which is subject to change.

The Financial Conduct Authority does not regulate estate planning or tax planning.

Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.

Comments on How the 2024 Autumn Budget could affect your family’s Inheritance Tax bill

There are 0 comments on How the 2024 Autumn Budget could affect your family’s Inheritance Tax bill