18 January 2022

After a couple of quarters where it seemed as if life was slowly returning to normal, the Omicron variant of the coronavirus emerged in the final three months of 2021.

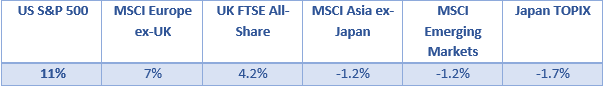

Cases have once again risen, although a major vaccine booster drive has helped to reduce serious instances of illness. In addition, while the path of the pandemic has often been difficult to predict, its impact on the global economy has lessened as both businesses and employees have adapted to operating in a pandemic environment. Over the final quarter of 2021 US, European and UK equities all rose while Asian shares and emerging markets contracted.

Source: JP Morgan

UK

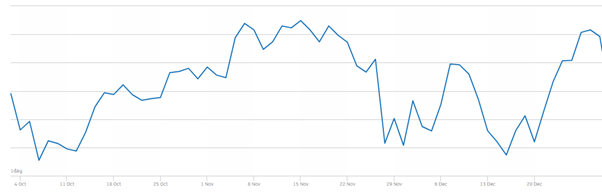

UK equities rose over the quarter, although it was a rocky ride as you can see from the graph below showing the FTSE 250 performance during the period from October to the end of December.

Encouraging news around the Omicron variant during December saw many areas of the market largely recoup the sharp losses they had sustained in the initial sell-off in late November.

Source: London Stock Exchange

The UK unemployment rate dropped to 4.2% despite the end of the furlough scheme. A record 1.2 million job vacancies is a clear indication of increasing labour market tightness that could cause further wage increases. The concern is that this will lead to even higher inflation after the Consumer Price Index hit 5.1% – its highest level in a decade.

The Bank of England reacted to the rising cost of living by raising interest rates by 0.15% to 0.25%.

US

President Biden signed the Infrastructure Investment and Jobs Act, a long awaited $1.2 trillion bipartisan infrastructure bill. The bill incorporates $550 billion of additional spending of which:

- 49% will be allocated to upgrading America’s transportation sector, including ports, airports, railroads, roads, bridges, and public transport

- 32% will be spent on improving water and power infrastructure

- 12% is for improving broadband

- 7% will be spent on the environment.

The employment market saw a huge improvement over the course of 2021, with the unemployment rate falling from 6.7% in December 2020 to 4.2% in November 2021.

S&P 500 earnings continued to rise, and the index hit a new all-time high in 2021. Earnings were boosted by strong consumer demand and higher productivity as businesses were able to reduce costs in a more virtual environment.

In November, the US Consumer Price Index (CPI) jumped to 6.8%, its highest reading in 39 years. In response, the Fed are likely to increase interest rates in the middle of 2022, with the potential for three rate hikes by the end of the year.

Europe

Eurozone shares made gains in Q4 with utilities and IT stocks among the top performers. Technology hardware and semiconductor stocks also performed particularly well.

Problems with an unreliable supply of Russian gas, and volatile energy prices, contributed to higher inflation with the Eurozone annual inflation rate reaching 4.9% in November 2021 (compare this to the rate of -0.3% a year earlier).

The European Central Bank said it would scale back bond purchases but ruled out interest rate rises in 2022.

Asia

When it comes to monetary policy, China is heading the opposite way to many western nations with measures that reflect the growing concerns of Chinese policymakers about risks to the economy. The People’s Bank of China (PBOC) cut the reserve requirement ratio (RRR) by 50 basis points and lowered the re-lending rate by 25 bps to support agricultural and small enterprises.

Across the whole of 2021, Chinese equities significantly underperformed global equities. This contributed to the 25% underperformance of emerging market equities when compared to developed markets.

The MSCI emerging markets index fell by 2.2% in 2021 while the Asia ex-Japan index fell by 4.5%.

One bright spot was the performance of Japanese equities. While they fell in Q4, the Japan TOPIX index rose by more than 12% across 2021 as a whole.

Get in touch

If you have any questions about anything you have read in this update, please get in touch. Email info@depledgeswm.com or call 0161 8080200.

Please note

This article is for information only. Please do not act based on anything you might read in this article.

Comments on Your Q4 2021 market update

There are 0 comments on Your Q4 2021 market update